Explore the evolving trends in global bovine semen sales for 2023. How are economic fluctuations and innovative breeding practices reshaping the dairy and beef sectors?

The 2023 Semen Sales Report from the National Association of Animal Breeders (NAAB) offers a detailed examination of the prevailing economic and genetic patterns within the global bovine semen industry. With NAAB members representing approximately 95% of the U.S. Artificial Insemination market, these statistics are indispensable for understanding semen sales trends in dairy and beef breeds, especially in light of the ongoing post-Covid challenges.

“After reaching new records for units sold in 2021 and successfully managing two years of disruptions to the supply chain and public health challenges during Covid, the global downturn post-Covid continues to impact the genetics industry, resulting in a second consecutive year of a decline in total dairy and beef units sold,” says Jay Weiker, president of NAAB.

This article delves into critical themes:

- Decline in total unit sales.

- Shifts in semen types used by U.S. dairy producers.

- Economic and geopolitical factors impacting exports.

- Emerging trends in heterospermic semen usage.

We offer a thorough analysis of the current market landscape and the evolving preferences of producers that are shaping the future of the bovine semen industry.

Join us as we scrutinize the decline in total dairy and beef semen units sold in 2023, investigate the shift in reproductive management practices, and dissect the impact of global economic and geopolitical factors on semen sales.

Introduction to 2023 Bovine Semen Sales Trends

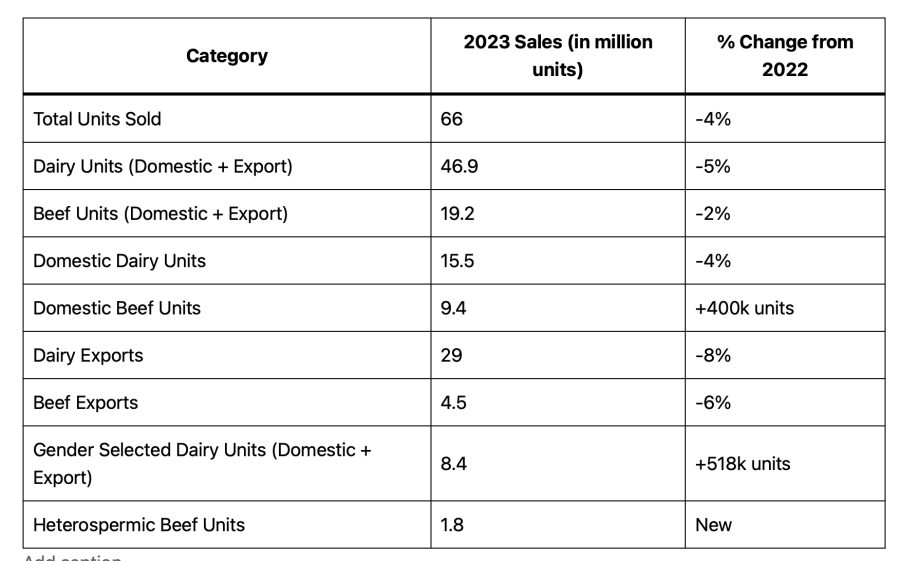

To provide a clearer understanding, the relevant data can be broken down as follows:

| Category | 2023 Sales (in million units) | % Change from 2022 |

|---|---|---|

| Total Units Sold | 66 | -4% |

| Dairy Units (Domestic + Export) | 46.9 | -5% |

| Beef Units (Domestic + Export) | 19.2 | -2% |

| Domestic Dairy Units | 15.5 | -4% |

| Domestic Beef Units | 9.4 | +400k units |

| Dairy Exports | 29 | -8% |

| Beef Exports | 4.5 | -6% |

| Gender Selected Dairy Units (Domestic + Export) | 8.4 | +518k units |

| Heterospermic Beef Units | 1.8 | New |

“The data clearly reflects the ongoing adjustments within the industry as producers respond to economic pressures, challenges in international markets, and the evolving demands of reproductive management programs.” – Jay Weiker, President of NAAB

The U.S. bovine semen industry experienced a 4% decline in total unit sales in 2023, dropping to 66 million units—a reduction of 2.9 million units compared to the previous year. Despite this downturn, the value of exported semen soared to a record $306 million, marking an increase in the average blend price.

Dairy unit sales plummeted by 5%, amounting to 46.9 million units—2.5 million units fewer than in 2022. Similarly, beef unit sales fell by 2% to 19.2 million units, a decrease of over 400,000 units year over year. These figures underscore the industry’s evolving landscape, prompting a need for strategic adjustments and innovation.

Examining the Decline in Domestic Dairy Semen Sales

The 2023 Semen Sales Report offers a comprehensive look at the current trends and challenges within the global bovine semen industry. With data reflecting a significant decline post-COVID-19 and evolving market dynamics, the report provides valuable insights for breeders, producers, and industry stakeholders.

The persistent downward trajectory of domestic dairy semen sales has been evident over the past four years, accumulating to a 3.7 million unit decline. In 2023, the market saw a further 4% decrease, equating to nearly 700,000 fewer units and reducing the domestic market size to 15.5 million units.

In stark contrast, the domestic beef semen market demonstrated resilience with a 400,000-unit increase in 2023, reaching 9.4 million units. Remarkably, 7.9 million of these units were utilized within dairy herds, as dairy producers strategically integrated beef genetics to yield high-value beef crossbred calves.

The shift towards gender-selected dairy semen showed notable growth, with a 7% increase of 518,000 additional units in 2023. This segment now comprises 54% of the total domestic dairy units, enabling producers to effectively manage herd compositions and accelerate genetic advancements.

These evolving dynamics highlight the strategic adaptations of U.S. dairy producers in response to market fluctuations, economic pressures, and state-of-the-art advancements in reproductive management technology.

Challenges in Dairy and Beef Exports

The downturn in dairy and beef semen exports can be attributed to multifaceted economic and geopolitical issues afflicting key markets. Once a dominant dairy importer, China has experienced an economic slump that has curtailed dairy production and diminished the demand for imported genetics.

Russia, a pivotal market for U.S. bovine semen, is grappling with geopolitical tensions and stringent economic sanctions, resulting in a significant drop in agricultural imports.

In Brazil, a strategic pivot towards beef production—particularly favoring Zebu—type genetics—has reduced reliance on conventional bovine semen imports.

These challenges underscore the intricate nature of the global export environment, necessitating a calculated and strategic reassessment to stabilize and rejuvenate semen export volumes.

Global Challenges: Production Costs and Labor Shortages

The evolving landscape of reproductive management practices is shaped by escalating production costs, labor shortages, and the imperative to curtail the carbon footprint of livestock production. Financial limitations galvanize the quest for breeding strategies that are both cost-effective and efficient.

Labor shortages necessitate automation and innovation, with nations like Japan and Australia pioneering robotic milking and automated feeding systems.

Sustainability initiatives are increasingly directed towards mitigating the environmental impact of livestock breeding. Utilizing gender-selected semen and beef semen in dairy herds emerges as a pivotal strategy.

Global trends underscore the critical need for adopting innovative reproductive management practices to enhance the resilience and growth of the livestock industry.

Dairy vs. Beef: Shifts in Semen Sales

The 2023 semen sales report highlights significant shifts in both dairy and beef semen markets, driven by global economic factors and changing agricultural practices. These shifts are evident in the nuanced data concerning the sales of dairy versus beef semen.

| Category | 2022 (Units) | 2023 (Units) | % Change |

|---|---|---|---|

| Total Dairy Semen Sales | 49.4 million | 46.9 million | -5% |

| Total Beef Semen Sales | 19.6 million | 19.2 million | -2% |

| Beef on Dairy Semen Sales | 6.4 million | 7.9 million | +23% |

| Beef on Beef Semen Sales | 13.2 million | 11.3 million | -14% |

| Gender Selected Dairy Semen | 7.9 million | 8.4 million | +7% |

| Conventional Dairy Semen | 41.5 million | 38.5 million | -7.2% |

“The preference for gender-selected and beef on dairy semen reflects a broader trend towards optimizing herd management and economic returns,” observes industry expert, Sophie Eaglen.

The dichotomy between dairy and beef semen sales has evolved, mirroring broader market and economic trends. The 4% decline in the U.S. bovine semen industry, totaling 66 million units, underscores this shift. The dairy sector saw a 5% reduction, losing about 2.5 million units to settle at 46.9 million units. The beef sector experienced a modest 2% decline, totaling 19.2 million units. This shift underscores the growing preference for beef semen among producers, driven by economic efficiency.

The adoption of beef-on-dairy breeding strategies is a pivotal indicator, with sales increasing by 1.5 million units both domestically and internationally. This strategic move aims to enhance economic returns, with crossbred calves substantially boosting feedlot profitability. In contrast, pure beef-on-beef semen sales fell by 1.4 million units, building on a previous 4 million unit decline in 2022, reflecting shifting market demands.

The rising costs associated with raising heifers to their first calving age compel dairy producers to balance replacement heifer production with generating high-value beef crossbred calves. This balance is achieved through the pragmatic use of gender-selected beef semen, offering a financial lifeline amidst escalating costs.

In 2023, U.S. dairy producers pivoted towards gender-selected dairy semen, reaching 8.4 million units, surpassing beef on-dairy units at 7.9 million and conventional dairy units at 7 million. This strategic shift optimizes genetic progress and economic viability, aiming to produce precisely the number of replacement heifers needed.

The introduction of heterosporic semen, with 1.8 million units sold and 1.3 million domestically, marks a significant innovation, positioning it as the second most popular beef ‘breed’ following Angus.

Global market dynamics significantly influence these trends. The rising demand for high-quality dairy and beef products pressures U.S. producers to innovate continuously. While domestic demand for conventional dairy semen diminishes, robust demand from the export sector sustains reliance on U.S. genetics. The industry’s strategies balance enhancing domestic production efficiencies and meeting robust international market demands.

The Rise of Gender-Selected Dairy Semen

The rise in gender-selected dairy semen usage marks a strategic evolution in the reproductive methodologies of dairy farmers. This technology, which significantly increases the likelihood of female progeny, is intrinsically tied to the economic demands of contemporary dairy farming, enhancing operational efficiency and maximizing output.

Domestically, a rise of 518,000 units in usage underscores a global pattern driven by international markets prioritizing precision and efficiency. With 54% of U.S. dairy units now consisting of gender-selected semen, we observe a considerable transformation within the industry.

Below is a detailed look at the rise of gender-selected dairy semen, both domestically and in export markets:

| Category | Units Sold (Million) |

|---|---|

| Gender-selected Dairy (Domestic) | 8.4 |

| Gender-selected Dairy (Export) | 8.6 |

| Total Gender-selected Dairy | 17.0 |

This shift not only propels genetic advancements but also facilitates targeted breeding strategies that elevate herd quality and boost milk production. Addressing the substantial costs of raising heifers offers a pragmatic approach to achieving predictable breeding outcomes.

The global embrace of this trend is evident, with 8.6 million units exported and significant uptake in markets like China and Brazil. This widespread adoption underscores a universal pivot towards optimized dairy operations leveraging advanced reproductive technologies.

Embracing gender-selected semen epitomizes the shift towards sustainable and economically sound dairy farming practices. As technology advances, its integration into reproductive management programs is set to expand, cementing its pivotal role in contemporary dairy breeding.

Heterospermic Semen: A New Player in the Market

The 2023 Semen Sales Report sheds light on several significant trends reshaping the U.S. bovine semen industry. Notably, the inclusion of heterospermic semen statistics has garnered attention, indicating its growing popularity among producers. Heterospermic semen, a combination of sperm from different bulls, seems to be establishing itself as a notable player in the market. Below are the detailed statistics for 2023:

| Category | Total Units Sold | Domestic Units | Export Units |

|---|---|---|---|

| Heterospermic Beef | 1.8 million | 1.3 million | 0.5 million |

“This makes heterospermic beef the second largest ‘breed’ of beef semen sold, following Angus in first place.”

Emerging as a significant trend within the 2023 semen sales statistics, heterospermic semen has made a marked impact on the market. Traditionally focused on purebred genetics, introducing heterospermic semen—a fusion of sperms from different bulls—has captivated breeders by enhancing genetic diversity and improving overall herd performance.

This innovative product addresses critical issues such as reducing genetic defects and optimizing the efficiency of breeding programs. In 2023, heterospermic beef semen saw substantial adoption, with 1.8 million units sold, including 1.3 million in the domestic market, making it the second most popular option after Angus.

The shift towards heterospermic semen marks a strategic evolution in breeding practices. It enables more effective genetic diversification while mitigating the risks associated with single-sire insemination. This approach harmonizes sustainability, productivity, and genetic health within herds.

The rapid market penetration of heterospermic semen illustrates the industry’s adaptability. It provides a solution that meets both economic and genetic improvement goals. To support this growth, it is essential to integrate heterospermic semen into global breeding programs.

Ultimately, the success of heterospermic semen highlights the sector’s dynamic nature. It is poised to revolutionize traditional breeding practices and pave new pathways for genetic advancement worldwide.

Top International Markets

| Rank | Country | Units Imported | Value (USD) |

|---|---|---|---|

| 1 | China | 8,400,000 | $108,000,000 |

| 2 | Brazil | 7,600,000 | $96,000,000 |

| 3 | United Kingdom | 6,200,000 | $92,000,000 |

| 4 | European Union | 5,900,000 | $88,000,000 |

| 5 | Russia | 5,400,000 | $84,000,000 |

The international landscape for U.S. bovine semen exports has significantly shifted in the past year. For the third consecutive year, China has cemented its position as the leading export market in total units and dollar value, underscoring its growing reliance on U.S. genetic material to bolster its dairy and beef industries.

Despite a reduction of 718,000 units from 2022, Brazil maintains its status as the second-largest importer by volume, driven by a strategic focus on Zebu type genetics. This shift clearly indicates Brazil’s evolving genetic preferences and market strategies.

The United Kingdom has become the second-highest market regarding dollar value, overtaking Russia. This change reflects the intricate geopolitical and economic challenges that have impacted Russia’s import capabilities.

There’s been a notable increase in high-value importers, with 37 international markets each importing over $1 million worth of U.S. bovine semen in 2023, and 16 countries exceeding the $5 million threshold, up from 11 countries in 2022. This surge in high-value importers signifies the broadening acceptance and robust demand for U.S. genetic material across diverse markets.

These top 37 markets collectively accounted for 92% of the total export units and 94% of the dollar value. These statistics underscore these key regions’ concentrated yet lucrative nature and highlight the expansive global footprint of U.S. bovine genetics. Moreover, they reflect ongoing adjustments by countries worldwide to optimize livestock production in the face of evolving economic and environmental challenges.

The Bottom Line

In the wake of a challenging economic landscape, the 2023 semen sales report delineates crucial trends and transformations within the bovine genetics arena. The ongoing global decline post-COVID has significantly impacted dairy and beef units, culminating in a 4% reduction in total sales. This decline, exacerbated by geopolitical dynamics such as China’s economic downturn and the instability in Russia, has led to a tepid performance in export sales, notwithstanding a record-breaking value in exports.

Domestic dairy semen sales continue their four-year descent, driven chiefly by a considerable shift towards beef units. This trend mirrors producers’ adaptive reproductive strategies to enhance economic outcomes amidst soaring heifer-rearing costs.

The rise of gender-selected and heterospermic semen products epitomizes the industry’s shift towards more specialized solutions. While domestic producers are increasingly turning to gender-selected dairy semen, the strong export demand for conventional semen underscores the diverse requirements of the global market.

The U.S. bovine genetics market’s resilience is demonstrated by the continued importation of high-value semen by leading international markets, despite various economic and logistical challenges. The emergence of heterospermic semen highlights the industry’s innovative approaches to addressing intricate market demands. These insights reaffirm the bovine genetics sector’s agility and deep connection to global economic conditions and industry performance.

Key Takeaways:

The 2023 Bovine Semen Sales Report highlights significant shifts and trends within the global genetics industry, reflecting both challenges and opportunities that lie ahead for producers and policymakers. The report, compiled by the National Association of Animal Breeders (NAAB), underscores pivotal changes in market dynamics, influenced by economic uncertainties, technological advancements, and evolving breeding strategies worldwide.

- Decline in Total Unit Sales: The global downturn post-COVID continues to impact the genetics industry, resulting in a 4% decline in total unit sales, marking a second consecutive year of reduced sales.

- Record Value of Exports: Despite a decrease in the number of units sold, the value of exported semen reached a new high of $306 million, indicating an increase in average blend price.

- Differential Impact on Dairy and Beef Sectors: Dairy semen sales experienced a substantial 5% decline, whereas beef semen sales saw a modest 2% decrease, with nuanced shifts between beef on dairy and beef on beef sales.

“The high value of young beef crossbred calves makes it very appealing to dairy producers to produce F1 calves for the feedlots, amidst rising costs of raising a heifer,” explained Jay Weiker, president of NAAB.

- Rise of Specific Semen Products: Gender-selected dairy semen and heterospermic semen units emerged as significant categories, with notable increases and market share, particularly within the U.S. market.

- Export Market Dynamics: While traditional markets like China and Brazil remain significant, geopolitical and economic challenges in regions like Russia have reshaped the export landscape, with the UK emerging as a top market by dollar value.

- Global Producer Challenges: Issues related to production costs, labor shortages, and environmental considerations are driving changes in reproductive management practices and the types of semen products utilized around the world.

Summary:

The 2023 Semen Sales Report from the National Association of Animal Breeders (NAAB) reveals a 4% decline in total dairy and beef semen sales, largely due to economic and geopolitical issues. Domestic dairy sales have been declining for four years, while the domestic beef semen market showed resilience, with a 400,000-unit increase in 2023. The shift in the industry is influenced by broader market and economic trends, with the dairy sector experiencing a 5% reduction and the beef sector experiencing a modest 2% decline. The introduction of heterosporic semen, the second most popular beef ‘breed’, is a significant innovation. The rise in gender-selected dairy semen usage is driven by international markets prioritizing precision and efficiency. Heterospermic semen, a fusion of sperms from different bulls, has also seen substantial adoption.