Explore the latest trends from Global Dairy Trade Event 364. How will a small price hike impact your dairy business? Read our expert analysis now.

Summary:

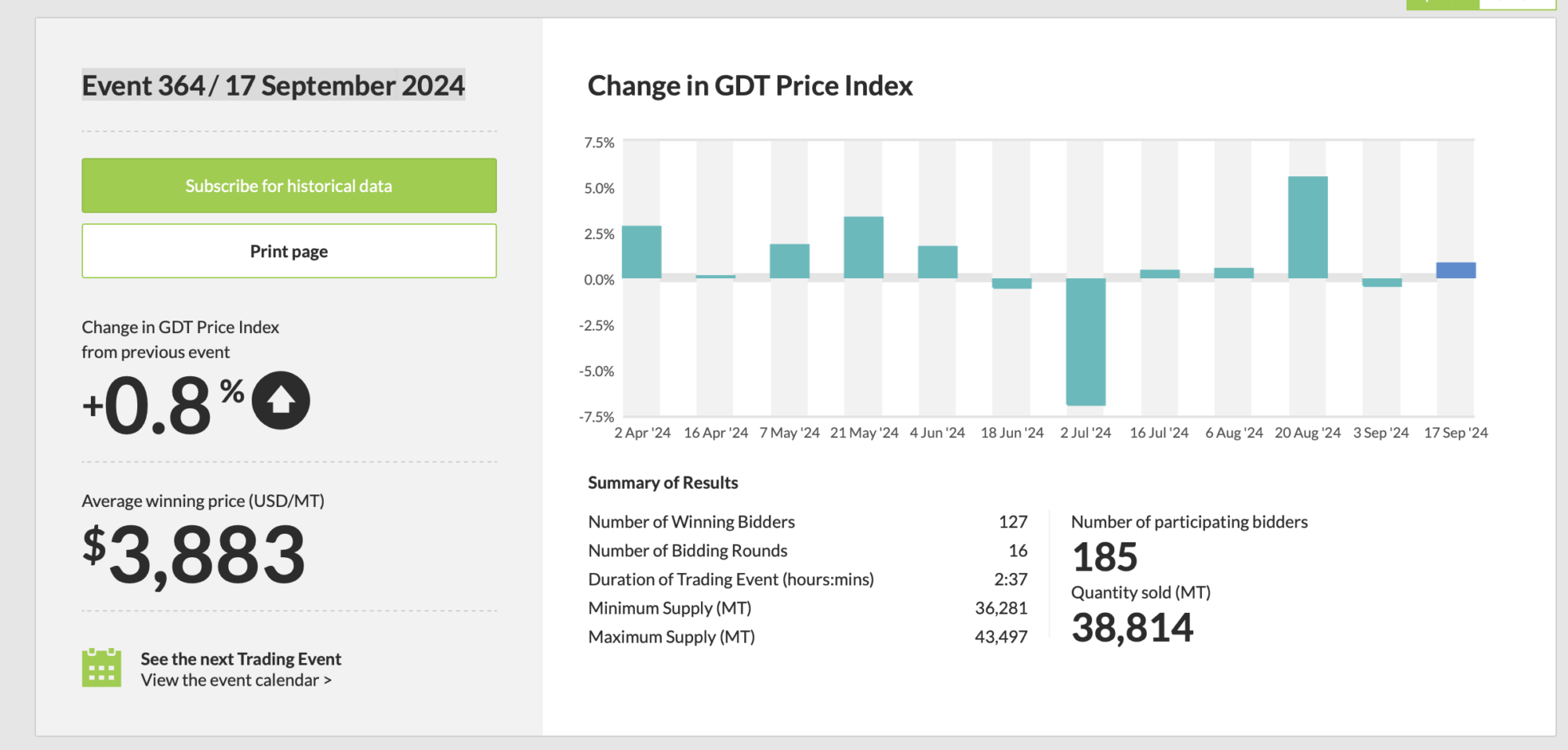

On September 17, 2024, the Global Dairy Trade (GDT) event 364 saw a modest increase in the price index by 0.8%, reflecting a cautiously optimistic market trend. Significant gains were noted in Mozzarella cheese (up 4.5% to $5,351/metric ton), lactose (up 3.5% to $896/metric ton), and modest increases in skim and whole milk powders, while butter and anhydrous milk fat prices saw a decline.

Key Takeaways:

- Global Dairy Trade index rose by 0.8% in the latest auction.

- Notable price increases for mozzarella, lactose, and cheddar cheese.

- Whole milk powder and skim milk powder also saw price hikes.

- Butter and anhydrous milk fat prices decreased.

- 127 winning bidders purchased a total of 38,814 metric tons of dairy products.

- Irish milk processors have raised August milk prices in response to market dynamics.

- Increases driven by strengthening cheese markets and positive dairy market recovery.

- The latest auction continued to show constrained global dairy supply.

On Tuesday, the Global Dairy Trade (GDT) index rose 0.8%, a seemingly tiny shift with substantial repercussions. The September 17, 2024, auction resulted in a 4.5% increase in mozzarella cheese costs, a 3.5% increase in lactose, and mild increases in skim and whole milk powder. On the negative, butter and anhydrous milk fat prices dropped. With 127 successful bidders acquiring 38,814 metric tons of dairy products in 16 bidding rounds, the most recent GDT event provides enough to analyze. Our careful analysis of these results will provide you with a comprehensive understanding of what these numbers mean to you.

Here’s a detailed breakdown of the price changes for various dairy products.

| Product | Price Change (%) | New Price (per metric ton) | New Price (per pound) |

|---|---|---|---|

| Mozzarella Cheese | +4.5% | $5,351 | $2.42 |

| Lactose | +3.5% | $896 | $0.40 |

| Cheddar Cheese | +2.9% | $4,441 | $2.01 |

| Skim Milk Powder | +2.2% | $2,809 | $1.27 |

| Whole Milk Powder | +1.5% | $3,448 | $1.56 |

| Anhydrous Milk Fat | -1.2% | $7,220 | $3.27 |

| Butter | -1.7% | $6,546 | $2.96 |

Auction Insights: Modest Gains Fuel Dairy Market Stability

The Global Dairy Trade (GDT) Event 364 took place on September 17, 2024. A total of 185 bidders competed, with 127 winning offers. The event sold 38,814 metric tons of dairy goods during 16 bidding rounds. The GDT index increased by 0.8% from 1,142 to 1,150 points. This minor increase signifies a sustained stability trend in the global dairy market, instilling cautious optimism for farmers and investors.

Fundamental Price Changes: A Closer Look

In this trading session, mozzarella cheese had the most significant price gain, rising by 4.5% to $5,351 per metric ton ($2.42 per pound). This is a considerable increase over the last auction, demonstrating strong demand for this versatile commodity.

Lactose followed soon after with a 3.5% hike, raising its price to $896 per metric ton ($0.40/pound), a healthy increase over the previous event.

Cheddar cheese prices increased significantly, up 2.9% to $4,441 per metric ton ($2.01 per pound). The cheddar category is doing vigorously, showing strong market fundamentals.

Skim milk powder (SMP) prices rose by 2.2% to $2,809 per metric ton ($1.27 per pound), a positive indicator given SMP’s vital position in the dairy sector.

Whole milk powder (WMP) contributed to the total price rise by 1.5%. It is now valued at $3,448 per metric ton ($1.56 per pound). Although small, this increase highlights the consistent need for WMP.

Detailed Analysis of Each Product

- Mozzarella Cheese: The 4.5 percent increase in mozzarella pricing to $5,351 per metric ton indicates strong demand. Key factors include rising worldwide consumption, driven mainly by the food service industry. Mozzarella’s versatility in culinary uses, including pizzas and salads, makes it popular throughout North America and Europe. Export markets with favorable trade circumstances also help to drive this growing trend.

- Lactose: Lactose witnessed a 3.5% rise, reaching $896 per metric ton. This is primarily due to the increased use of lactose in newborn formula and sports nutrition products. The growing health awareness of consumers has enlarged the lactose market, notably in Asia and the Middle East. Furthermore, the steady demand from the pharmaceutical industry supports its market price.

- Cheddar Cheese: Cheddar prices rose 2.9% to $4,441 per metric ton. Cheddar is durable due to its shelf-stable qualities, vast customer base, and consistent demand from the retail and food service industry. The recent demand for premium and aged cheddar variations has also raised the average price.

- Skim Milk Powder (SMP): SMP prices climbed by 2.2%, reaching $2,809 per metric ton. The increase may be attributed to essential export nations experiencing supply restrictions due to severe weather conditions hurting milk production. Furthermore, rising demand from Southeast Asia and Africa for high-protein dairy products is crucial.

- Whole Milk Powder (WMP): The 1.5% increase in WMP to $3,448 per metric ton is due to strong import demand from China and Latin America, where whole milk powder is standard in many diets. Geopolitical issues and beneficial trade agreements contribute to these price increases.

Factors Behind Price Decreases

- Anhydrous Milk Fat (AMF): Prices for AMF declined 1.2% to $7,220 per metric ton. This decline is partly due to increasing production and storage in key dairy-producing nations, which resulted in a surplus. Furthermore, evolving consumer preferences toward plant-based fat substitutes in critical countries such as the United States and Europe put downward pressure on AMF pricing.

- Butter: Butter prices fell 1.7% to $6,546 per metric ton, indicating an oversupply. Increased milk fat yields owing to better dairy nutrition practices and stock conservation from prior eras contribute to this reduction. Butter replacements’ increasing market penetration impacts their conventional market share.

The Ripple Effect: How Global Dairy Trade Prices Shape Local Markets

Changes in global dairy trade (GDT) auction prices substantially impact regional markets. Take the Irish milk processors as an example. The slight increase in pricing at the most recent GDT event caused firms such as Dairygold and Carbery to raise their milk prices for August supply. Why? Because they see good tendencies in global market dynamics and want to take advantage of them.

Dairygold raised the stated milk price by 1.19c/l, excluding VAT, to 43.65c/l. This is not a haphazard change but a deliberate reaction to the market’s ongoing excellent returns and vigorous purchasing activity. A spokeswoman stated: “Dairy market returns continue to be positive, with market prices improving as buying activity increases and global supply remains constrained.”

Similarly, Carbery moved substantially by increasing its introductory milk price for August by 3c/l, minus VAT, to 44.28c/l. What is their rationale? Cheese markets are becoming more robust, and the dairy business is recovering and doing well overall. “This increase in milk price is driven by strengthening markets for cheese and continuing positive dairy market recovery and performance,” according to Carbery.

These regional price modifications by Dairygold and Carbery highlight the interdependence of global market movements and local pricing tactics. It demonstrates that even small changes in auction prices may have a knock-on impact, affecting grassroots choices.

Market Implications: What These Price Changes Mean for You

The modest uptick in the GDT price index, particularly in mozzarella and lactose, signals a cautious yet positive trend in the dairy sector. This should instill a sense of optimism and hope for you, the dairy farmer or the supplier to the industry, as it suggests a potential for increased profitability and growth in the near future.

- A Boost for Dairy Farmers: Higher pricing for mozzarella and lactose provides some respite to dairy producers. Farmers should anticipate increased income streams as cheddar, skim, and whole milk powder gain popularity. These small price increases help dairy producers sustain their earnings. It is an encouraging indicator in the face of global supply restrictions.

- Opportunities for Suppliers: Companies that sell dairy products, such as feed, equipment, and technology, stand to benefit as farmers become more willing to spend. The recent increase in milk pricing by processors such as Dairygold and Carbery supports this attitude. With a more robust market for cheese and milk powders, producers will most likely reinvest in their enterprises. This creates a fertile environment for providers to deliver sophisticated solutions.

- Beneath the Surface: Analyzing Demand and Supply: While price rises are desirable, analyzing the underlying causes is essential. Prices are growing as demand gradually increases against a background of tight supply. However, the drops in anhydrous milk fat and butter prices remind us that the market is still unpredictable. Disrupted manufacturing cycles continue to impact global supply networks, influencing inventory levels and, as a result, pricing.

The Bottom Line

The recent Global Dairy Trade auction showed a slight overall gain of 0.8% in the price index, led by significant increases in mozzarella and lactose prices, among other things. While certain items like butter and anhydrous milk fat saw price drops, the increase suggests a steady market condition. This auction demonstrates the volatile nature of global dairy pricing and the vital necessity for industry stakeholders to monitor such occurrences actively.

Learn more:

- Surging Cheese and Lactose Prices in Latest Global Dairy Trade Event 361

- Global Dairy Trade Experiences a Noteworthy 1.8% Rise: Insights from Event 355

- US Dairy Farmers’ Revenue and Expenditure Rise Slightly in March

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!