MAHA’s health revolution could crown traditional dairy kings or crush processors. Discover winning strategies for the $1.7T policy shift reshaping your milk market.

EXECUTIVE SUMMARY: The MAHA initiative’s crackdown on ultra-processed foods presents dairy producers with unprecedented opportunities and risks. Traditional whole-food dairy products (fluid milk, artisanal cheeses, butter) stand to gain market share as consumers shift from additive-laden options. In contrast, processed dairy items in cereals and frozen meals face existential threats. Plant-based alternatives’ reliance on synthetic ingredients makes them vulnerable, creating a surprising competitive edge for clean-label dairy. Successful operators are already reformulating products, embracing regenerative practices, and aligning with upcoming USDA guidelines. With 29 states advancing food additive bans, proactive adaptation to cleaner production methods and strategic policy monitoring will separate industry winners from casualties.

KEY TAKEAWAYS:

- $3.50 Premium Power: Consumers pay $2.54-$3.53 more for clean-label yogurts – reformulate now

- Plant-Based Trap: 78% of alt-dairy products qualify as ultra-processed under MAHA guidelines

- Regulatory Countdown: 75+ state bills target additives – California bans four chemicals starting 2027

- Quiet Wins: Major brands successfully reformulate yogurts without taste changes or fanfare

- Methane Bonus: Seaweed feed cuts dairy emissions by 52-95% while aligning with MAHA’s whole-food ethos

The Make America Healthy Again (MAHA) initiative, spearheaded by Secretary of Health and Human Services Robert F. Kennedy Jr., represents significant global opportunities and potential challenges for dairy producers. With control over $1.7 trillion in federal spending—a quarter of the annual U.S. federal budget and nearly twice what the military spends—Kennedy’s influence on food policy could dramatically reshape dairy markets in ways that innovative producers should be preparing for now.

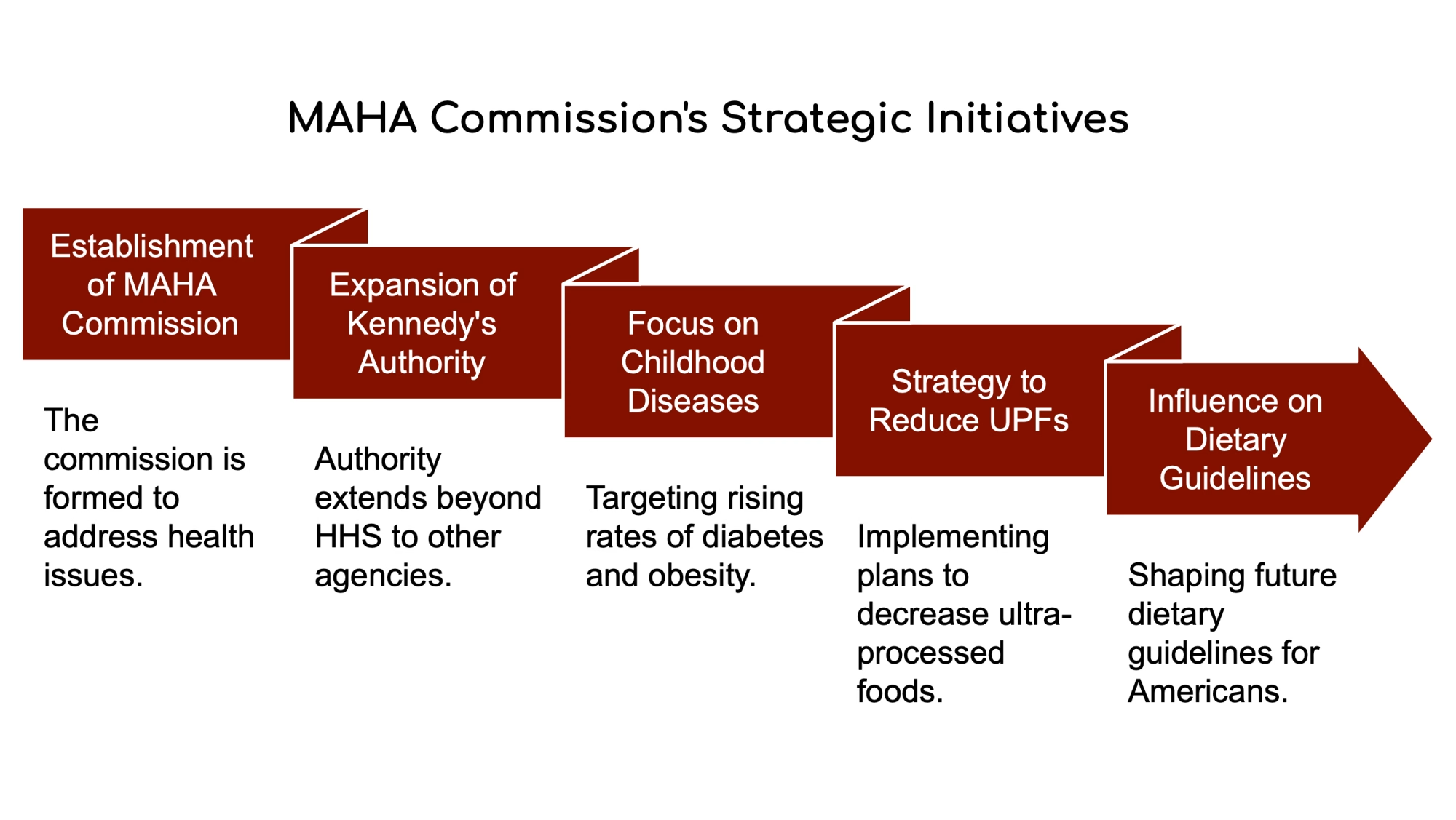

The Power and Scope of MAHA

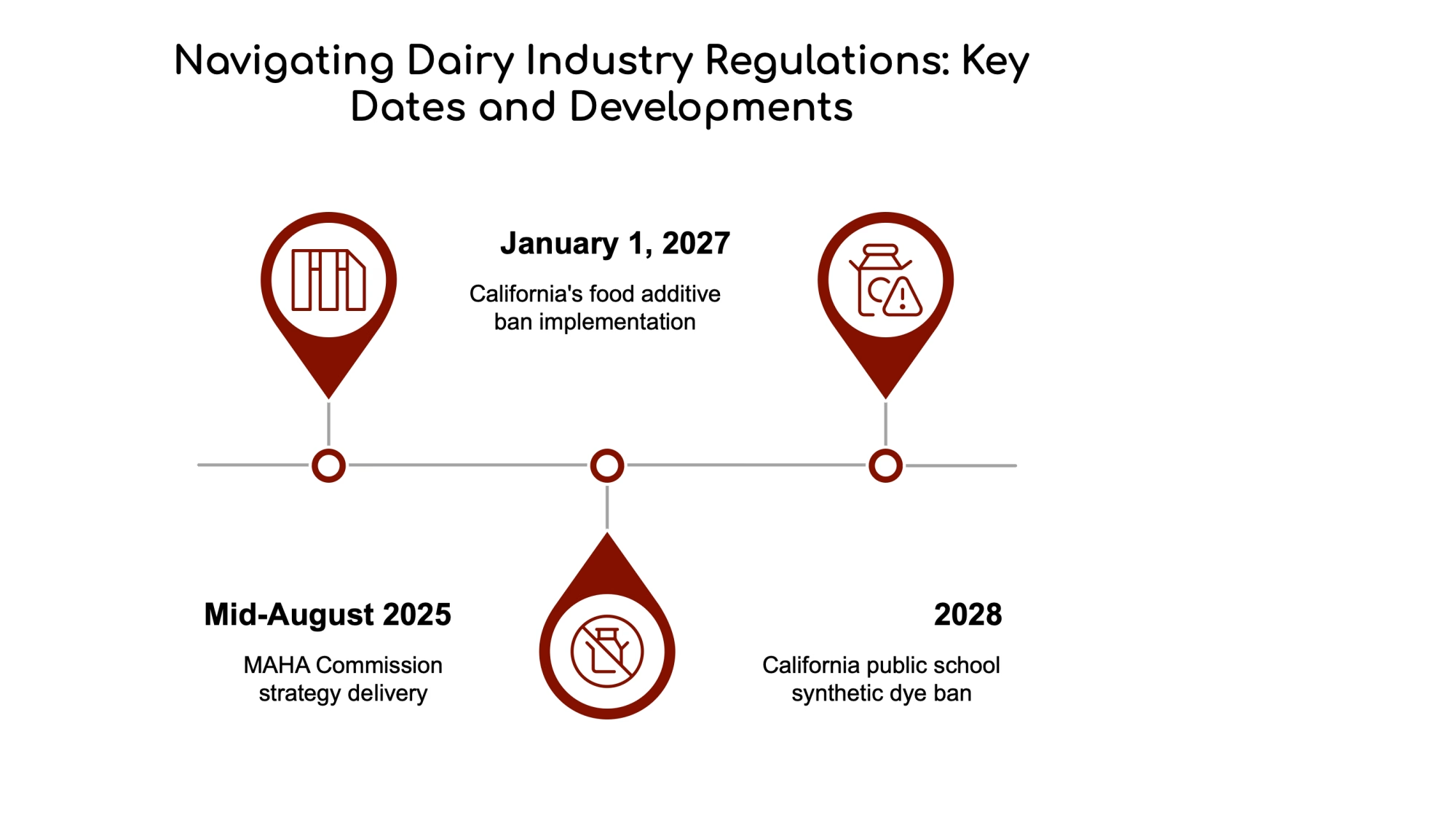

The MAHA Commission, established by President Donald Trump, has significantly expanded Kennedy’s authority beyond just HHS to include other agencies, including the USDA. This cross-agency approach gives the initiative unprecedented muscle to implement sweeping changes to America’s food system by August 2025, when the Commission must publish its strategy on “appropriately restructuring the Federal Government’s” approach to health.

The commission’s primary mission is tackling the alarming rise in childhood diseases like diabetes and obesity. At the heart of this effort is a laser focus on reducing ultra-processed foods (UPFs) in the American diet—products containing lengthy lists of additives, preservatives, and non-nutritive ingredients that have become staples in modern food consumption.

One of Kennedy’s most immediate avenues for addressing UPFs will be influencing the upcoming revisions to the Dietary Guidelines for Americans, set for release later in 2025. These guidelines don’t just influence individual consumer choices—they dictate purchasing decisions for massive federal programs like the National School Lunch Program, which must comply with them.

The Bright Side: Potential Windfalls for Traditional Dairy

For traditional dairy farmers, MAHA could represent a significant market opportunity. In its purest form, milk is the quintessential whole food—nutritionally dense, minimally processed, and perfectly aligned with MAHA’s vision of healthier eating.

The push against UPFs could trigger a renaissance for traditional dairy products:

Fluid Milk Revival

Public health experts recommend that children “mostly drink water and plain milk” while limiting plant-based alternatives, flavored milk, and other sweetened beverages. As consumers potentially shift away from ultra-processed breakfast options like sugary cereals, the opportunity exists for marketing milk as a stand-alone breakfast beverage rather than merely a cereal complement.

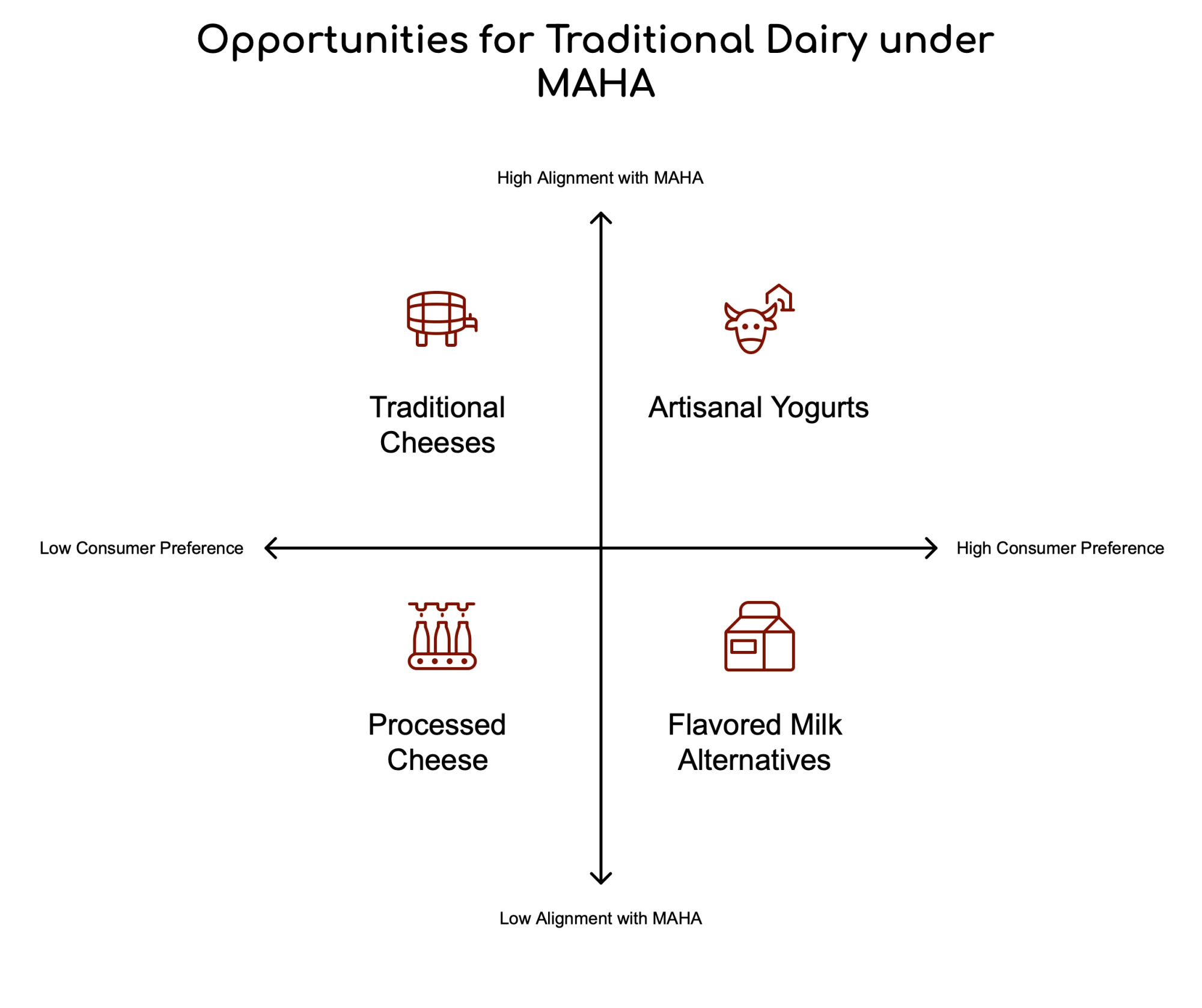

Traditional Cheeses and Yogurts

Artisanal and traditionally produced cheeses and yogurts with simple, clean ingredient lists stand to gain significant market share as consumers seek less processed alternatives. Research shows consumers are willing to pay a premium of $2.54 to $3.53 for 32 oz of clean-label yogurt formulations. These products align perfectly with MAHA’s emphasis on whole foods with minimal additives.

Butter’s Continued Renaissance

Real butter, already experiencing growing popularity as consumers move away from artificial spreads, could see further demand increases under MAHA’s whole food philosophy.

The Dark Side: Challenges for Processed Dairy Products

Not all dairy categories will benefit equally from MAHA’s focus. Several dairy-heavy product categories could face headwinds:

Highly Processed Cheese Products

If shelf-stable cheese products with extensive ingredient lists are categorized as UPFs, they may face scrutiny and declining consumer acceptance. This trend may push manufacturers toward reformulations with cleaner labels.

Dairy in Breakfast Cereals

The potential impact on breakfast cereals is particularly concerning. With Americans consuming approximately 14 pounds of cereal annually, any decline in this category could significantly impact dairy demand. The milk consumed daily with cereal represents a substantial market segment that could be disrupted.

Frozen Meals and Snacks

In complex formulations, many frozen meals and snacks containing dairy ingredients (cheese, butter, cream) could face regulatory pressure or consumer rejection. These products often contain numerous additives that place them squarely in MAHA’s crosshairs.

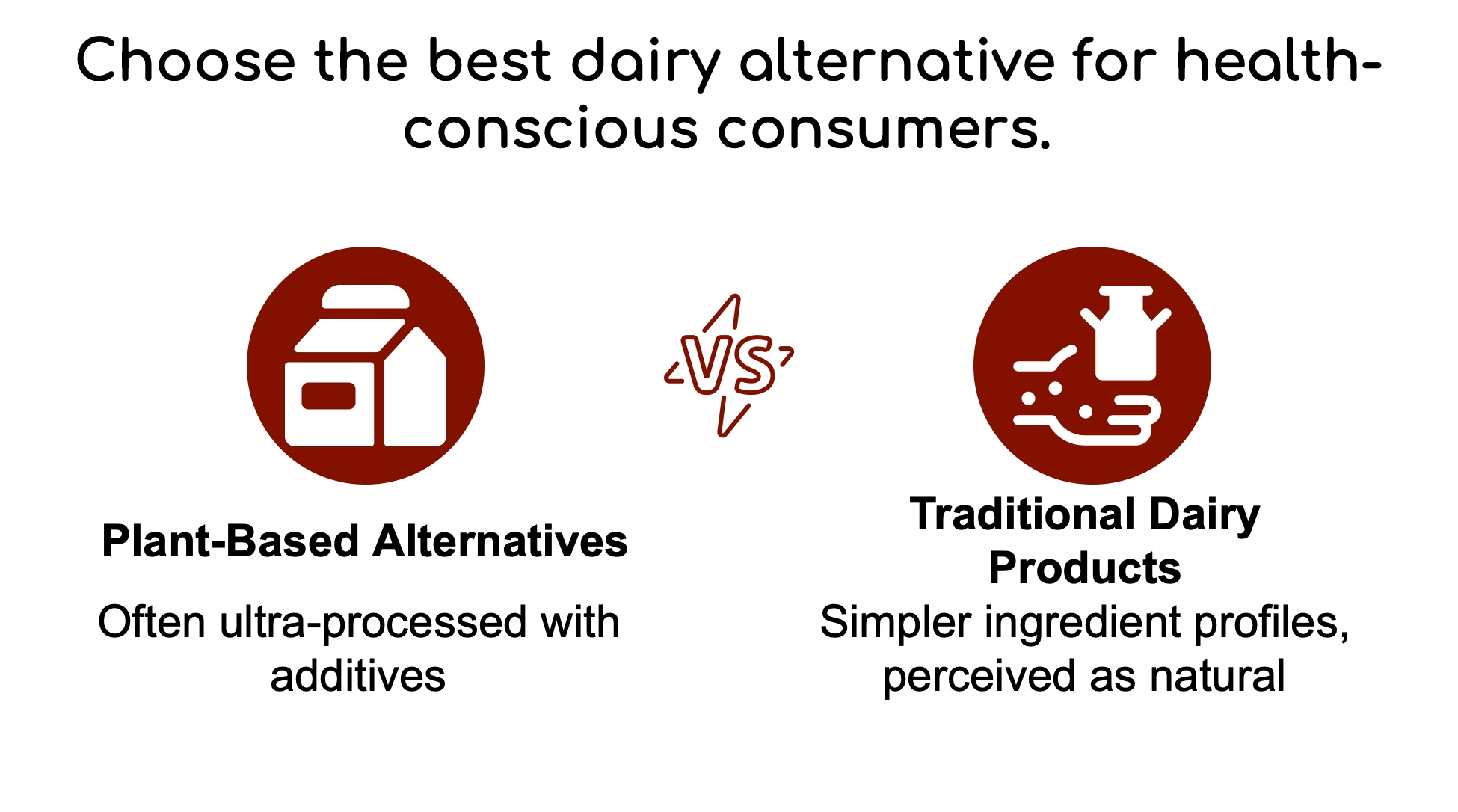

Competitive Advantage Over Plant-Based Alternatives

One unexpected silver lining: MAHA could complicate the growth trajectory of plant-based dairy alternatives. While positioned as “natural” alternatives to dairy, many plant-based milk, cheese, and yogurt products contain extensive lists of additives, emulsifiers, and stabilizers—precisely the ingredients MAHA aims to reduce.

Scientific research shows that most plant-based dairy alternatives are classified as ultra-processed foods (UPFs) according to the NOVA food classification system due to their ingredient composition, despite their marketing as healthier alternatives. This creates a competitive advantage for traditional dairy products with more straightforward ingredient profiles.

Risk Management Strategies for Dairy Businesses

Forward-thinking dairy businesses should consider several strategic approaches to navigate the MAHA era:

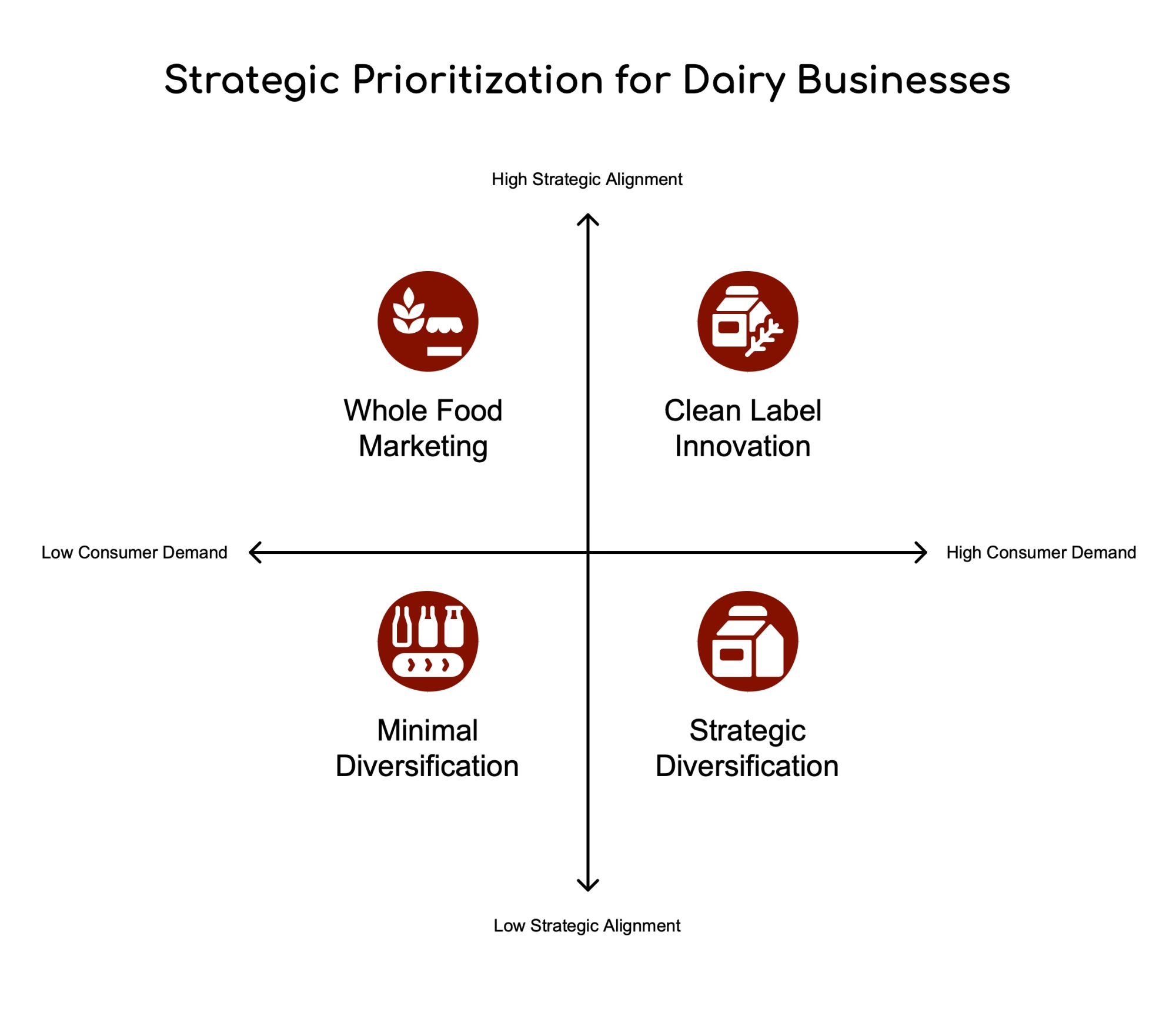

Reformulation and Clean Label Innovation

Dairy processors should accelerate clean-label initiatives for processed products, removing artificial additives and simplifying ingredient lists. According to research by Ingredion, 69% of US consumers want to see “made with recognizable ingredients” claims on yogurt, dairy alternative yogurts, ice cream, and processed cheese packaging. In comparison, 68% want “no artificial ingredients/no preservatives” claims.

A case study from Ingredion demonstrates how a global dairy manufacturer successfully reformulated a popular yogurt line to clean label standards without compromising texture, appearance, or taste—and with no discernible difference to consumers. This “quiet, clean label transformation” shows it’s possible to maintain product quality while meeting clean label demands.

Marketing Emphasis on “Whole Food” Dairy

Marketing campaigns highlighting dairy’s status as a minimally processed, nutritionally complete food could resonate strongly with consumers influenced by MAHA messaging. The simplicity of traditional dairy production methods becomes a valuable selling point.

Diversification of Product Offerings

Dairy businesses heavily invested in UPF categories should diversify toward less processed offerings. The MAHA Commission’s agenda development timeline (through August) gives companies a narrow window to begin this transition.

Strategic Monitoring of Policy Development

With the MAHA Commission set to deliver its strategy by mid-August 2025, dairy companies must stay vigilant about evolving regulations. Even if the federal MAHA agenda faces obstacles, state-level activity remains robust, with 29 states already introducing more than 75 bills to regulate food additives as of early 2025.

Key policy arenas to monitor include:

Dietary Guidelines Revisions

Changes to these guidelines will directly impact institutional dairy purchases through the National School Lunch Program, potentially favoring less processed dairy options.

Food Additive Bans

California has already passed legislation banning specific food additives, including Red Dye 3, brominated vegetable oil, potassium bromate, and propylparaben, from all food sales in the state starting January 1, 2027. Another bill bans six synthetic food dyes from foods in California public schools beginning in 2028. The FDA is also feeling pressure to act, with Deputy Commissioner Jim Jones hinting in December 2024 that a ban on Red Dye 3 would be announced: “in the next few weeks.”

State-Level Food Additive Regulations

The patchwork of state regulations creates compliance complexity and potential opportunities for dairy products with clean labels. New York and Pennsylvania have introduced similar bills to ban questionable ingredients, which will likely be revived in 2025.

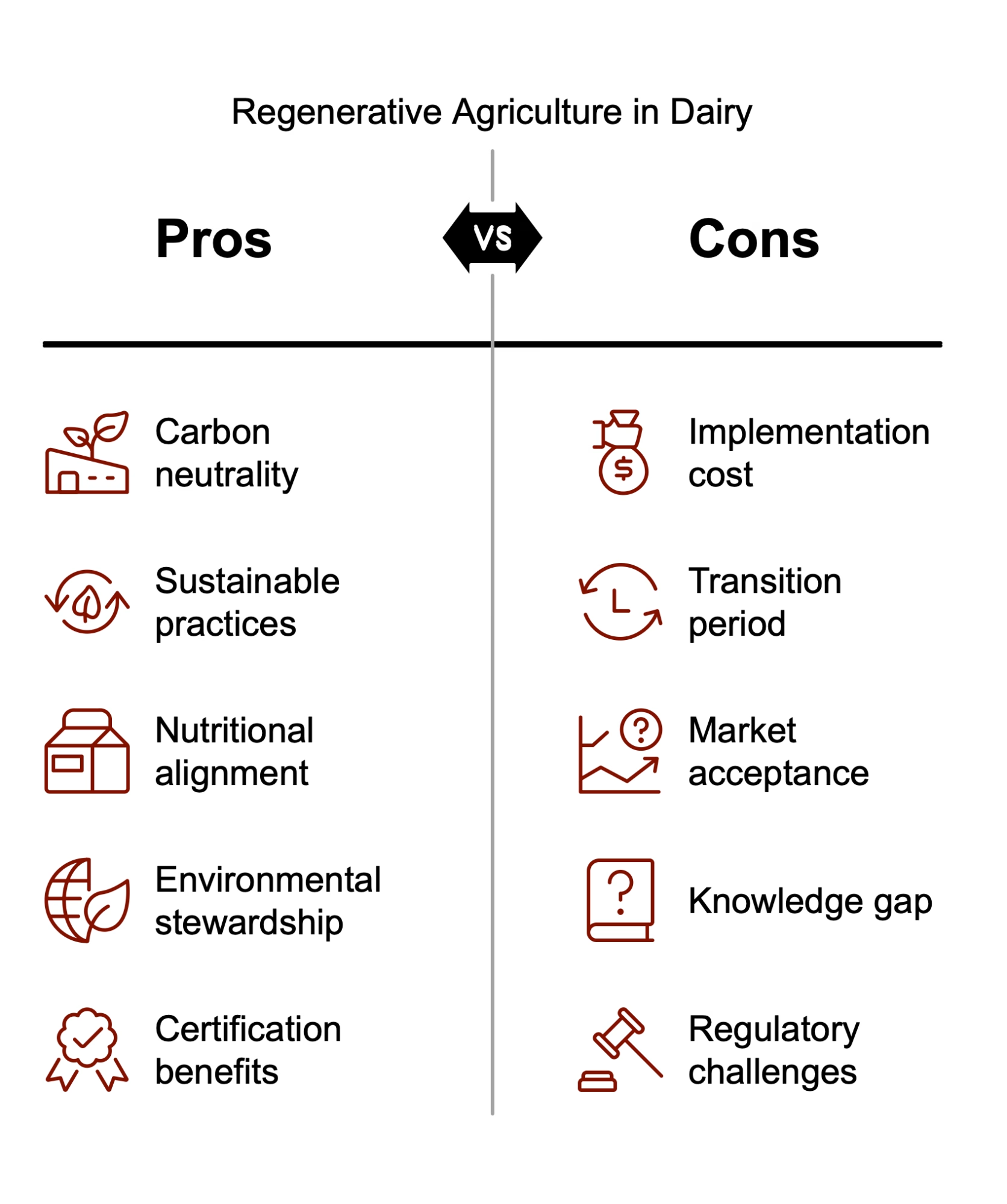

The Regenerative Agriculture Advantage

Dairy producers embracing regenerative agriculture may find themselves well-positioned in the MAHA landscape. Companies like Straus Family Creamery in Northern California are pioneering sustainable dairy farming methods as part of broader efforts to become carbon neutral.

Once Upon a Farm, which recently entered the dairy category with A2/A2 Whole Milk Shakes and Smoothies, has partnered with Alexandre Family Farm, the first Certified Regenerative dairy farm in the US. The farm received this status in 2021 for its carbon sequestering practices via rotational grazing.

John Foraker, co-founder, and CEO of Once Upon a Farm, explains that regenerative farming practices align with their nutritional standards and environmental stewardship goals: “We want to work with the best possible partners who are very much aligned with us in terms of the positive impact that we have to make not just on nutrition, but also on the planet. Organic dairy does dairy way better than conventional”.

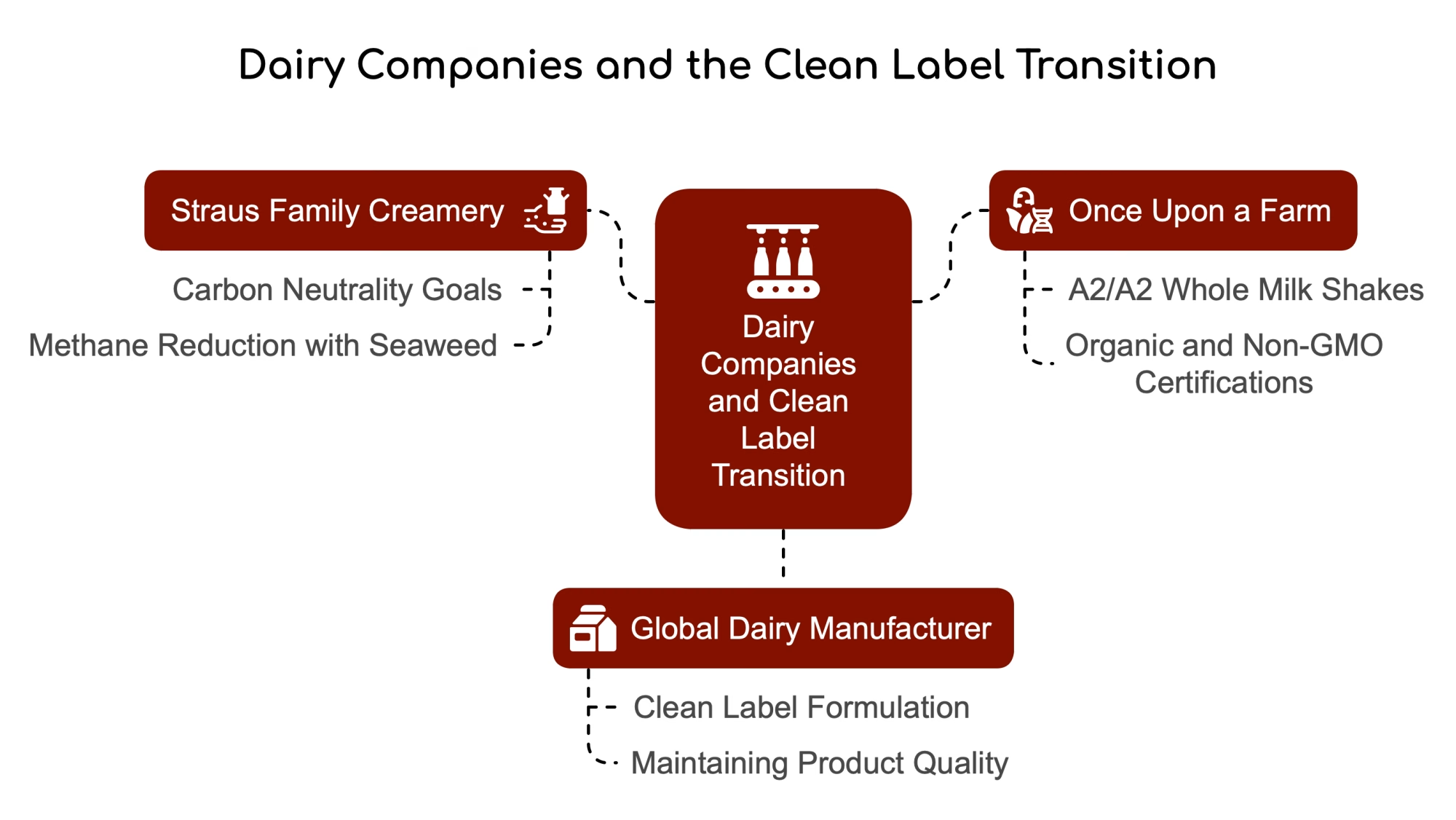

Case Studies: Dairy Companies Leading the Clean Label Transition

Straus Family Creamery: Pioneering Sustainable Dairy

Straus Family Creamery in Northern California demonstrates how traditional dairy can align perfectly with modern health and sustainability concerns. The company is helping pioneer more sustainable ways to manage dairy cows as part of its broader effort to become carbon neutral by 2030.

As a USDA-approved pilot program participant, Straus has shown that adding a quarter pound of red seaweed to a cow’s 45-pound diet can reduce enteric methane from belches by an average of 52% and up to 95%. This innovative approach allows traditional dairy to address health and environmental concerns simultaneously.

Once Upon a Farm: Regenerative Dairy Done Right

Once Upon a Farm’s January 2025 entry into the dairy category showcases how companies can successfully position dairy products to appeal to health-conscious consumers. Their A2/A2 Whole Milk Shakes and Smoothies, sourced from Alexandre Family Farms’ grass-fed cows, focus on taste (with no added sugar), texture, and farm standards for organic, regenerative dairy.

The company carefully balances its marketing claims, featuring USDA Organic, Non-GMO Project Verified, and Clean Label Project certifications on its products. John Foraker explains, “We are not overstating regenerative, organic and its impact on our business because it is such a small part of what we are doing – but it is a start, and it is on dairy.”

Global Dairy Manufacturer: The Quiet Clean Label Transformation

A case study from Ingredion demonstrates how even large-scale dairy processors can successfully transition to clean-label formulations without disrupting consumer expectations. As part of a global initiative to reformulate its dairy products, a well-known yogurt brand worked with Ingredion to develop a clean label formulation that maintained the same texture and taste while using consumer-friendly ingredients.

The key to success was finding the right functional native starch (NOVATION® 3300) to withstand the high temperatures of yogurt processing while delivering great texture, appearance, and taste. The reformulation was implemented as a “quiet, clean label transformation” without highlighting the changes. Yet, it successfully extended the company’s clean label initiative into challenging product lines with no discernible difference to consumers.

This approach demonstrates that dairy companies can transition to cleaner labels without compromising on product quality or manufacturing efficiency—a crucial consideration for businesses navigating the MAHA landscape.

Action Plan for Dairy Producers

Immediate Steps (Next 90 Days)

- Conduct an audit of your product portfolio to identify items most vulnerable to UPF classification.

- Begin R&D on clean label reformulations for your most at-risk products

- Develop marketing materials highlighting the whole-food credentials of your minimally processed dairy offerings

Medium-Term Strategy (6-12 Months)

- Invest in consumer education about the nutritional benefits of traditional dairy compared to highly processed alternatives.

- Explore partnerships with regenerative agriculture practitioners to strengthen your sustainability story.

- Begin transitioning high-risk product lines to cleaner formulations before regulatory pressure intensifies.

Long-Term Vision (1-3 Years)

- Position your brand as a leader in clean, minimally processed dairy that aligns with MAHA principles.

- Develop new product lines specifically designed to meet the emerging clean-label standards.

- Build resilience against regulatory changes by diversifying your portfolio toward whole-food dairy offerings.

The dairy industry stands at a crossroads. By embracing the principles of clean labels, minimal processing, and transparent ingredient lists, forward-thinking dairy businesses can turn the MAHA movement from a potential threat into a significant competitive advantage.

Conclusion: Navigating Dairy’s MAHA Future

The emerging MAHA movement represents a consequential shift in America’s food policy landscape that will create winners and losers within the dairy industry. Traditional, minimally processed dairy products stand to gain significant market share, while heavily processed dairy formulations face potential regulatory and consumer challenges.

The industry’s ability to adapt to these changes—reformulating products, emphasizing dairy’s whole food credentials, and strategically navigating the evolving regulatory landscape—will determine which businesses thrive in the MAHA era.

The writing is on the wall for dairy farmers and processors: the future belongs to cleaner, simpler, more traditional dairy products. Those who embrace this reality sooner rather than later will find themselves well-positioned to capture market share in an increasingly health-conscious America.

Learn more:

- Why Donald Trump Hates Canada’s Dairy Supply System

Explores the trade tensions underpinning U.S.-Canada dairy relations, critical for understanding MAHA’s geopolitical context. - Innovative Cheese, Butter, and Yogurt Drive Dairy Market Growth

Details how clean-label dairy innovation aligns with MAHA’s anti-UPF agenda, offering actionable strategies for product reformulation. - Dairy Farming Showdown: Canada vs USA

Compares regulatory frameworks that shape dairy competitiveness—essential context for navigating MAHA-driven policy shifts.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!