What’s behind the surprising uptick in U.S. milk production? Let’s dive into the implications for dairy farmers and the industry’s future challenges and opportunities.

Summary:

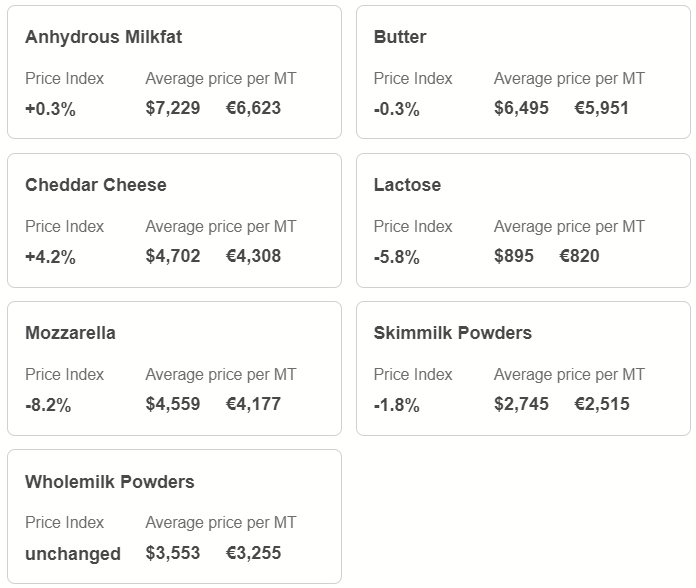

U.S. milk production has shown an unexpected uptick after over a year of decline. The latest USDA report highlights this slight growth, with September production up by 0.1% compared to last year and August’s projections revised to a 0.4% increase. While these trends might lead to lower milk and dairy product prices, challenges remain with avian influenza affecting California and poor forage in Wisconsin. Yet, states like Idaho, Texas, and New York display strong growth. Navigating these changes, the dairy sector must adapt and strategize for stability. Are we seeing a temporary surge or a long-term trend? Your insights on this shift are invaluable.

Key Takeaways:

- The U.S. milk production experienced an unexpected increase in August and September 2024, likely influencing lower milk and dairy product prices.

- Despite challenges such as avian influenza affecting California, milk output remained consistent with year-ago levels in the state.

- Idaho, Texas, and New York reported notable year-over-year increases in milk production, contrasting with Wisconsin’s slight decline.

- The U.S. dairy herd saw slight fluctuations but remained significantly smaller than the previous year’s figures.

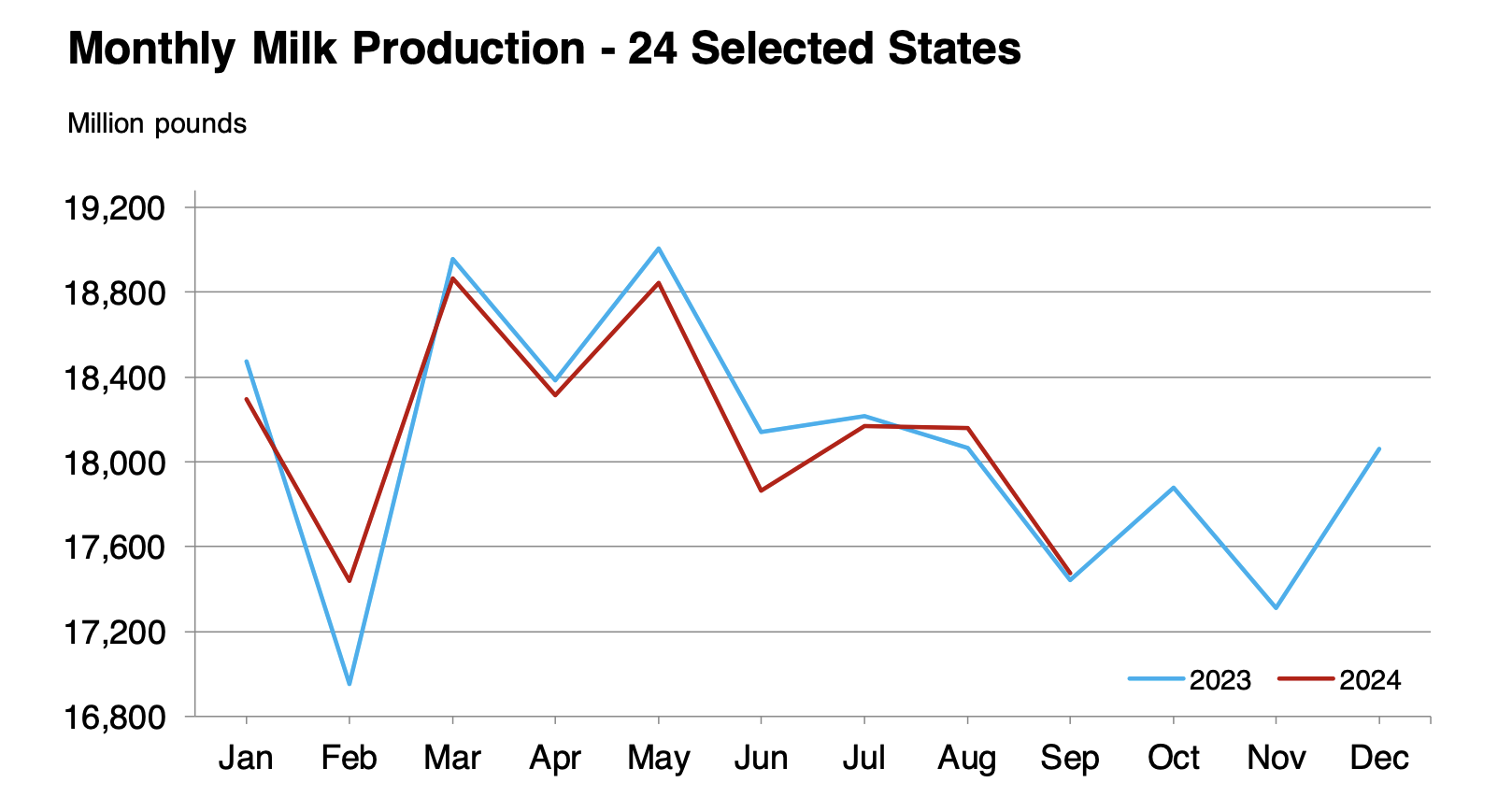

- Production metrics for the 24 significant states showcased a modest rise in both milk production and output per cow in September 2024 compared to the prior year.

- The July-September quarter demonstrated a slight overall growth in U.S. milk production, continuing a cautious upward trend.

Predictability is a rare commodity in a world where the recent, unexpected surge in U.S. milk output stands out. After a period of declining yields, this sudden upturn prompts us to question whether it’s a fleeting trend or a new era for the dairy industry. What does this unforeseen increase mean for dairy producers and the broader agricultural landscape? Is it a temporary blip, or does it signal a sustained shift towards higher production levels? As we delve into the details, consider how this revitalization in milk production could impact your company’s plans and financial performance.

A New Chapter in Dairy Dynamics: Is the Milk Production Surge a Game Changer or a Temporary Spike?

The recent surge in milk output, observed between August and September, marks a significant shift in the U.S. dairy sector. After a period of stagnation, this increase could potentially reshape market dynamics and long-term industrial strategy, signaling a move towards higher productivity.

This rise may initially put downward pressure on milk and dairy product prices. When supply meets or exceeds demand, prices often fall. This may benefit consumers, but dairy farmers may need to help maintain profit margins. The critical issue remains for stakeholders: Is this rise a blip or the start of a new trend?

Several variables might determine whether this alteration is transient or permanent. Technological innovations, such as improvements in cow genetics and farm management approaches, help increase production. External elements, such as climatic and regulatory settings, will also significantly impact.

Only months of diligent observation and analysis will allow stakeholders to determine whether this milk production surge is a one-time or long-term trend. Dairy farmers and industry experts must remain vigilant, adapt their methods, and make necessary adjustments to capitalize on these changes.

Regional Resurgence: How States Adapt and Thrive Amidst Dairy Challenges

California’s dairy industry, famed for its regular production, experienced unexpected hurdles when avian influenza spread. Despite this, the state’s output levels remained consistent, demonstrating the durability and strength of California’s dairy infrastructure in the face of environmental challenges. This resistance begs the question of how epidemic management strategies may protect other places from similar risks.

Wisconsin, known as America’s Dairyland, had a 0.5% decrease in milk output. Who is the culprit? Inadequate pasture quality is a harsh reminder of how dairy yields naturally depend on feed quality. This situation emphasizes the importance of pasture management in sustaining output levels, indicating an increasing need for precision agricultural technology to detect and alleviate such concerns.

Idaho’s milk production has risen by a surprising 1.8%. This upsurge might be attributed to favorable meteorological circumstances and advances in agricultural equipment and methods, suggesting that Idaho’s approach could serve as a model for other states seeking development.

Despite the tragic setback of a big fire, Texas saw a remarkable 4.9% increase. This increase demonstrates the state’s capacity to recover and expand. It underscores the importance of resilience planning and recovery frameworks in assuring continuity in the face of unexpected interruptions and reassuring the industry.

In New York, output increased by 1.2%, most likely owing to advances in cow genetics and farm management practices. These components highlight the advantages of investing in technology and research, implying the possibility of continued productivity improvements in the state.

Subtle Shifts in the Dairy Herd: Navigating Between Optimism and Economic Constraints

As recent events show, the dairy herd in the United States increased by 9,000 head in August, slightly approaching the production frontier. In contrast to a constant herd size in September, this increase illustrates producers’ cautious optimism. They await long-term favorable circumstances or policy reforms before making significant investments.

Despite these short-term gains, the picture over a slightly longer time frame shows a falling trend, with the herd size 38,000 heads lower than in September 2023. This decrease highlights the effect of current economic restraints, which force dairy businesses to downsize as part of cost-cutting measures. This continual herd shrinkage may limit future output capacity if cow productivity improves.

These dynamic fluctuations in herd size are anticipated to have an essential influence in setting market patterns. A smaller herd limits prospective yield growth, which may reduce supply unless matched by greater productivity per cow. A consistent herd size, without overextension, protects against a saturated market, which might drive down prices. The future trajectory heavily depends on external variables like regulatory changes, feed prices, and the ebb and flow of global dairy demand.

Market analysts and industry players must decide whether this stable herd size represents a new standard in the U.S. dairy business or a forerunner to future growth. As environmental, economic, and regulatory factors change, attentive attention to herd dynamics will be critical for anticipating and negotiating future adjustments in dairy production outputs.

Efficiency Over Expansion: The Blueprint for Sustainable Dairy Growth

Dissecting the fundamental variables determining milk production reveals a story of incremental progress paired with stability, notably in the September statistics. The average yield per cow was an impressive 1,966 pounds, reflecting a numeric rise and suggesting qualitative improvements in agricultural operations and cow management. What does this reveal about the sector’s progress toward sustainability and efficiency?

Although the overall number of milk cows decreased slightly from August to September 2024, remaining at 8.89 million, the effects are far-reaching. Focusing on improving production per animal rather than increasing herd numbers provides a possible blueprint for long-term success. It promotes a less-is-more strategy, prudently using natural resources and reducing surpluses that might disrupt market dynamics.

This operation indicates a transition to a more sustainable dairy farming framework. Focusing on animal health, breeding strategies, and feed optimization may improve efficiency. However, how equipped are stakeholders to implement these sustainable practices for long-term success?

These measurements serve as both a reminder of previous resilience and a road map for future possibilities. The dairy industry is on the verge of a transformational phase in which efficiency is more than just a slogan but a viable road ahead. Are we prepared to welcome it?

Strategic Equilibrium: Is the Dairy Industry Treading a New Path with Production and Herd Balance?

The minor increase in milk output to 56.0 billion pounds during the July-September quarter represents a subtle but substantial change in the United States dairy sector. Although not spectacular, this rise represents a significant shift in the relationship between herd size and total output. The average number of milk cows, 9.33 million, offers insight into the industry’s efforts to preserve balance. It’s a planned balance, showing that producers may be more concerned with utilizing current resources than randomly raising herd numbers.

This stability in herd numbers and incremental productivity increases per cow implies a cautious but positive outlook for maintaining output levels. The fact that herd numbers have not swollen out of proportion provides a buffer against future price decreases caused by oversupply. Furthermore, this balanced strategy may build the basis for resilience to the economic and environmental stresses the dairy business has traditionally faced.

As the sector navigates these minor alterations, the fundamental issue remains: Are these developments signs of a more stable future, or are they only temporary adjustments? The emphasis on balancing herd size with production efficiency might indicate a viable route ahead, implying a possible shift in the industry’s operational procedures and future development strategy.

Charting the Future: Is Your Dairy Business Ready for Technological and Environmental Paradigms?

The dairy sector constantly changes, and foresight is required to stay ahead. Technological developments are one crucial trend transforming the sector. Continuous innovation in genetics and herd management technology has the potential to improve production efficiency and cost management significantly. Consider the capacity to use data-driven insights to fine-tune every element of your operations—do you have the tools to profit from them?

Meanwhile, the impending climate change must be addressed. Its effects are unpredictable, influencing everything from feed quality to water availability. Consider techniques to strengthen your agriculture. Integrating heat-resistant feed alternatives, minimizing water consumption, and reducing carbon impact are all positive measures. Have you started implementing such strategies?

Furthermore, the need to adopt sustainable practices is higher than ever. Pursuing sustainability is more than simply an ideal; it is a must for future-proofing your company against environmental and regulatory challenges. As external variables continue to impact the market, how can you guarantee your company’s viability and competitiveness?

The Bottom Line

The dairy sector constantly changes, and foresight is required to stay ahead. Technological developments are one crucial trend transforming the sector. Continuous innovation in genetics and herd management technology has the potential to improve production efficiency and cost management significantly. Consider the capacity to use data-driven insights to fine-tune every element of your operations—do you have the tools to profit from them?

Meanwhile, the impending climate change must be addressed. Its effects are unpredictable, influencing everything from feed quality to water availability. Consider techniques to strengthen your agriculture. Integrating heat-resistant feed alternatives, minimizing water consumption, and reducing carbon impact are all positive measures. Have you started implementing such strategies?

Furthermore, the need to adopt sustainable practices is higher than ever. Pursuing sustainability is more than simply an ideal; it is a must for future-proofing your company against environmental and regulatory challenges. As external variables continue to impact the market, how can you guarantee your company’s viability and competitiveness?

Adapting to these more significant trends is more than simply survival; it is also about placing your business to prosper in a changing economy. You can negotiate these changes and embrace chances that arise if you remain knowledgeable and adaptable. How can you adapt and develop as the industry evolves under these diverse influences?

Learn more:

- Will Favorable Margins Propel U.S. Milk Production to New Heights?

- Is 2024 Shaping Up a Disappointing Year for Dairy Exports and Milk Yields?

- Unveiling the USDA Milk Report: Find Out Which States are Leading and Lagging!

Join the Revolution!

Join the Revolution!

Bullvine Daily is your essential e-zine for staying ahead in the dairy industry. With over 30,000 subscribers, we bring you the week’s top news, helping you manage tasks efficiently. Stay informed about milk production, tech adoption, and more, so you can concentrate on your dairy operations.

Join the Revolution!

Join the Revolution!