Mozzarella soars 5.1% while powder plummets! Is your milk heading to the right place? The smart money’s in cheese – are you cashing in?

EXECUTIVE SUMMARY: Tuesday’s Global Dairy Trade auction revealed a dramatic market divide that savvy dairy producers can’t afford to ignore: mozzarella cheese prices surged an impressive 5.1% while skim milk powder dropped 0.4%, creating a 5.5 percentage point spread between winners and losers. This widening gap signals a fundamental shift in the global dairy landscape where value-added products like cheese consistently outperform commodity ingredients. Regional advantages are emerging, with cheese-focused North American and European operations potentially outperforming powder-dependent Southern Hemisphere producers. Forward-thinking dairy farmers should immediately audit where their milk ends up, optimize for components that boost cheese yield, explore direct partnerships with specialty cheese makers, and implement strict quality protocols to capture available premiums. The market is clearly rewarding producers who ensure their milk flows into high-value streams rather than simply focusing on volume.

KEY TAKEAWAYS

- MARKET DIVIDE: Mozzarella cheese jumped 5.1% to $4,704/MT while skim milk powder fell 0.4% to $2,729/MT in Tuesday’s GDT auction, continuing a pattern of cheese outperforming powder.

- COMPONENT VALUE EXPLOSION: Every 0.1 percentage point increase in milk protein can boost cheese yield by 0.25 pounds per hundredweight, creating substantial financial opportunity when cheese prices surge.

- ACTION REQUIRED: Implement the five-step Dairy Producer Action Plan – audit your milk’s destination, optimize components, explore direct partnerships, leverage quality premiums, and hedge strategically.

- REGIONAL IMPLICATIONS: North American and European producers with cheese exposure stand to benefit most, while Southern Hemisphere operations heavily dependent on powder exports face continued margin pressure.

- SUCCESS MODEL: The Larson family dairy boosted their milk check 22% above neighbors by negotiating direct supply agreements with specialty cheese makers and implementing strict quality and component management.

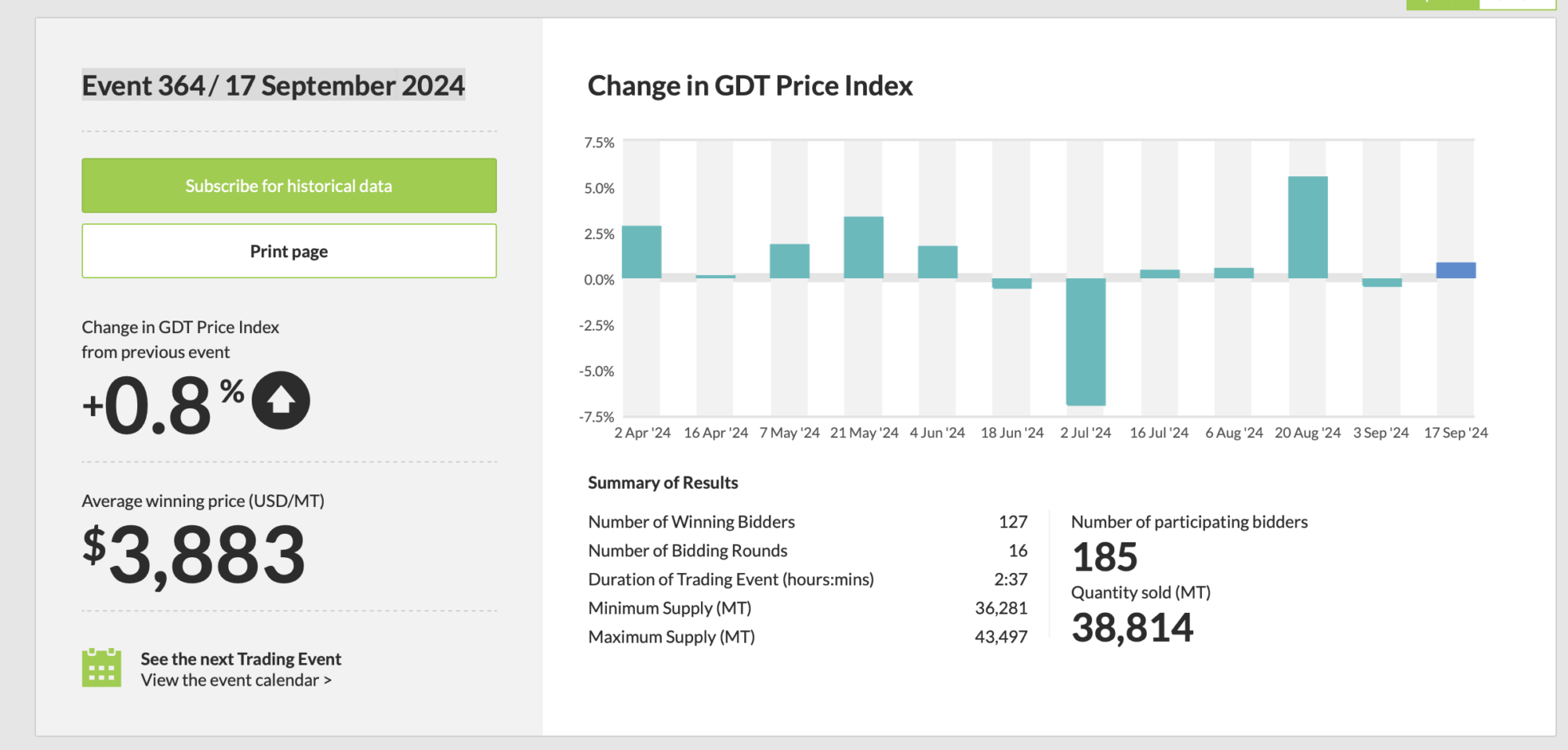

The latest Global Dairy Trade auction reveals what savvy dairy farmers already knew – the smart money is in cheese! Tuesday’s trading showed mozzarella prices soaring a whopping 5.1% while skim milk powder producers watched their products sink again. This widening gap between winners and losers isn’t just market noise – it’s a clear signal that processors without cheese in their portfolios are leaving serious money on the table.

CHEESE CHAMPIONS DOMINATE AUCTION SCENE

When the dust settled on Tuesday’s trading session, the overall Global Dairy Trade Index remained unchanged, but that headline masks the real story – cheese is king in today’s dairy landscape. Mozzarella led the charge with a stunning 5.1% price surge to $4,704 per metric ton ($2.13 per pound), continuing a pattern of strength in the cheese market.

Cheddar wasn’t far behind, posting a solid 1.0% gain to $4,976 per metric ton ($2.25 per pound). These aren’t just incremental movements – they represent a fundamental shift where value is created in the global dairy supply chain.

The cheese category’s strength has followed an established pattern in recent trading sessions. In the March 6th auction, mozzarella posted an even more impressive 7.9% gain to $4,477 per metric ton, even as the overall GDT index declined by 0.5%. This continued momentum in the cheese sector deserves our attention.

WHO’S CASHING IN?

Dairy farmers supplying milk to cheese-focused processors are the winners in today’s market. With 111 winning bidders battling through 18 rounds of competitive bidding for 19,540 metric tons of product, demand remains fierce despite uneven category performance.

Processors with flexible manufacturing capabilities who’ve invested in cheese production are laughing all the way to the bank. Meanwhile, those locked into powder-heavy portfolios scramble to explain diminishing returns to their farmer suppliers.

POWDER MARKET FALTERS WHILE FAT DIVERGES

The powder sector is weak, with skim milk powder dropping by 0.4% to $2,729 per metric ton ($1.23 per pound). This represents a reversal from the previous auction on March 6th, when skim milk powder had increased by 0.6% to $2,744 per metric ton.

“There are safety relief mechanisms in Federal Orders that are only expected to be employed when the system isn’t working properly. One of those is de-pooling of milk… when processors routinely find that obligations to pay the minimum milk price are more than they can recover from their product prices.” — Dr. Mark Stephenson, dairy economist.

Whole milk powder barely remained above water, with a meager 0.2% increase to $4,052 per metric ton ($1.83 per pound). This modest rise does little to recover from the 2.2% drop in the March 6th auction, when WMP fell to $4,061 per metric ton.

Perhaps most interesting is the divergence in the fat markets. Butter managed a respectable 1.1% increase to $7,667 per metric ton ($3.47 per pound), while anhydrous milk fat (AMF) dropped by 1.8% to $6,561 per metric ton ($2.97 per pound). This widening spread between premium consumer-facing products (butter) and industrial ingredients (AMF) tells us consumers are still willing to pay for branded dairy products while food manufacturers are squeezing suppliers.

UNDERSTANDING THE CHEESE-POWDER DIVIDE

Why are we seeing such dramatic differences between cheese and powder markets? The answer lies in fundamentally different market dynamics:

Cheese markets typically respond more quickly to consumer demand signals, with restaurant and retail sales driving value. These markets also benefit from product differentiation and branding, allowing producers to capture premium pricing with strong demand.

Powder markets, by contrast, function more as commodity ingredients, with prices heavily influenced by global stocks and industrial demand. These products face stronger international competition and typically experience more volatile price swings based on supply fundamentals.

The numbers don’t lie – see below precisely how much cheese outperforms other dairy commodities in today’s market. This performance gap directly translates to processor margins and producer milk checks.

PRODUCT PERFORMANCE SCORECARD – MARCH 18, 2025 GDT AUCTION

| PRODUCT CATEGORY | PRICE CHANGE | CURRENT PRICE (USD/MT) | CURRENT PRICE (USD/LB) |

| CHEESE WINNERS | |||

| Mozzarella | +5.1% | $4,704 | $2.13 |

| Cheddar | +1.0% | $4,976 | $2.25 |

| FAT PRODUCTS | |||

| Butter | +1.1% | $7,667 | $3.47 |

| Anhydrous Milk Fat | -1.8% | $6,561 | $2.97 |

| POWDER PRODUCTS | |||

| Whole Milk Powder | +0.2% | $4,052 | $1.83 |

| Skim Milk Powder | -0.4% | $2,729 | $1.23 |

| Lactose | +0.5% | $1,165 | $0.52 |

| Butter Milk Powder | N/A | N/A | N/A |

Source: Global Dairy Trade Auction Results, March 18, 2025

Understanding these different market cycles helps explain why innovative processors have invested in flexibility – the ability to shift production emphasis toward higher-value products when market signals support such moves.

THE POWDER PERSPECTIVE: WHY SOME REGIONS STICK WITH WHAT WORKS

While cheese is winning the value battle right now, there are legitimate reasons some regions remain committed to powder production:

Powder production offers several advantages that explain its continued prominence in global dairy:

- Shelf-life and storage benefits—Powder can be stored for extended periods without refrigeration, which is critical for distant export markets.

- Transportation economics – Removing water reduces shipping costs dramatically, allowing producers to reach far-flung markets cost-effectively.

- Processing flexibility – Powder can be reconstituted for various applications, from infant formula to bakery products, providing end-use versatility.

- Production scale advantages – Large drying operations achieve economies of scale that specialized cheese plants may not match.

“Every dairy market has different structural advantages. New Zealand’s grass-based seasonal production model aligns perfectly with powder export markets. At the same time, Wisconsin’s cheese focus reflects regional expertise and proximity to major consumer markets.” — Mary Ledman, Global Dairy Strategist, Rabobank.

The imaginative play isn’t necessarily abandoning powder entirely but ensuring your operation aligns with the right product mix for your specific regional advantages and market opportunities.

DAIRY PRODUCER ACTION PLAN: POSITIONING FOR PROFIT

Don’t just read these market signals – act on them! Here’s your five-step action plan to capitalize on the cheese-powder divide:

1. AUDIT YOUR MILK’S DESTINATION

Call your cooperative or processor today and ask these specific questions:

- What percentage of my milk goes into cheese production versus powder?

- How does your product mix compare to industry averages?

- What premium programs exist for cheese-quality milk?

2. OPTIMIZE YOUR COMPONENT STRATEGY

With cheese outperforming powder, protein, and fat components deserve extra attention:

- Evaluate your current feeding program with your nutritionist specifically for component optimization

- Consider genetic selection focused on cheese yield traits

- Implement management practices that boost components, not just volume

“Every 0.1 percentage point increase in milk protein can boost cheese yield by 0.25 pounds per hundredweight. That’s real money when cheese prices surge.” — Dr. Dave Barbano, Professor of Food Science, Cornell University.

3. EXPLORE DIRECT PARTNERSHIPS

Forward-thinking producers are bypassing traditional channels:

- Investigate specialty cheese makers in your region seeking dedicated milk supplies

- Consider producer coalitions that can collectively negotiate better terms

- Evaluate feasibility of on-farm processing focused on high-value products

4. LEVERAGE QUALITY PREMIUMS

Cheesemakers pay up for milk that performs better:

- Implement strict protocols for somatic cell count reduction

- Monitor bacterial counts obsessively

- Document and promote your quality management practices

5. HEDGE STRATEGICALLY

Don’t leave yourself exposed to market swings:

- Work with a knowledgeable broker to develop a cheese-focused hedging strategy

- Consider options strategies that protect the downside while maintaining the upside potential

- Stay informed through weekly market analysis reports

WHAT THIS MEANS FOR YOUR OPERATION

The message couldn’t be more straightforward for progressive dairy producers – your milk’s destination matters more than ever. The 5.1% premium jump in mozzarella versus the 0.4% decline in skim milk powder represents a massive value gap that directly impacts your bottom line depending on which processing stream your milk enters.

Industry analysts suggest this price divergence could create regional advantages, though the full impact remains to be seen:

- North American producers with significant cheese exposure may be better positioned than their powder-dependent counterparts.

- European processors with investments in specialty cheese production could leverage their market position for premium returns.

- Southern Hemisphere producers approaching their autumn production season may need to reconsider their heavy reliance on powder exports.

SUCCESS STORY: PIVOT TO PROSPERITY

The Larson family dairy in Wisconsin’s cheese country saw this market divide coming years ago and made strategic decisions that are paying off handsomely today:

“We were shipping to a commodity plant with no incentive for components beyond the Federal Order minimums,” explains Tom Larson. “After seeing the cheese premium trend emerging, we approached three specialty cheese makers and negotiated a direct supply agreement with component bonuses 15% above base Class III.”

Their strategy included:

- Shifting feed rations to boost protein components

- Implementing strict quality protocols that earned additional premiums

- Developing a three-year contract with gradual volume increases

- Retaining flexibility to expand direct marketing relationships

The result? “Our milk check runs 22% higher per hundredweight than neighboring farms still focused on volume alone,” Larson notes. “It required investment in record-keeping and management, but the payoff has been substantial.”

MARKET OUTLOOK: TURBULENCE AHEAD

While Tuesday’s trading session showed remarkable stability in the overall index, the dramatic category differences suggest underlying market turbulence that savvy producers need to navigate. The GDT has shown volatility in recent auctions, with the March 6th session showing a 0.5% overall decline despite strength in cheese.

Several factors will shape dairy markets in the coming months:

- Shifting consumer preferences continue to favor cheese and premium butter over commodity ingredients.

- As the Southern Hemisphere approaches autumn, regional production shifts will impact global supply dynamics.

- Processing capacity decisions by primary cooperatives and manufacturers will respond to these price signals.

“Higher prices will come when domestic and global demand resurges in 2025.” — Ken Bailey, PhD, Dairy Industry Economist.

The next GDT auction will tell us whether cheese’s dominant performance represents the beginning of a sustained rally or just another short-term market swing. But the trend is clear – commodity producers are getting squeezed while value-added manufacturers thrive.

BOTTOM LINE

Don’t get caught on the wrong side of this market divide. If your milk is flowing primarily into powder production, it’s time to have serious conversations with your cooperative or processor about their product mix strategy. Innovative producers are already exploring options to shift their milk toward higher-value cheese streams.

The latest GDT results confirm what leading dairy operations have known for months – the path to profitability isn’t through producing more milk but ensuring it goes into the right products. With mozzarella outperforming skim milk powder by 5.5 percentage points in a single trading session, the financial implications for your operation couldn’t be more precise.

“Dairy farmers are the clear winners when they align their production with high-value markets. With 111 winning bidders battling through 18 rounds of competitive bidding for 19,540 metric tons of product, demand remains fierce for the right products.”

Will you be among the winners riding the cheese wave or the losers stuck in the powder trap? The choice might determine whether your operation thrives or survives in 2025’s increasingly divided dairy marketplace.

Learn more

- Dairy Markets Under Pressure: Trade Tensions Reshape Export Landscape – Analysis of how new tariffs on U.S. dairy exports are reshaping markets. NDM and whey prices fall while cheese stabilizes.

- Billion-Pound Milestone: Navigating the Global Cheese Boom – The global cheese market is experiencing unprecedented growth, with US exports surpassing 1 billion pounds for the first time in history.

- U.S. Dairy Exports Shatter Billion-Pound Barrier – U.S. cheese exports hit a record 1.12 billion pounds in 2024, making America the #1 global supplier.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.