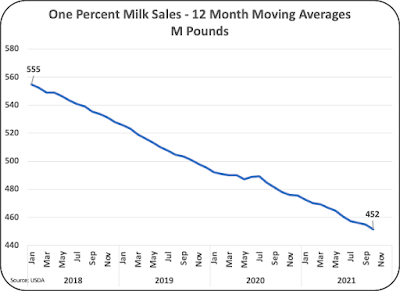

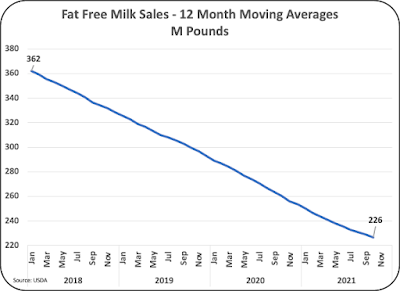

Milk consumption is down 42% from what it was a half-century ago — from 247 pounds per person in 1975 to just 144 pounds today, and that has put a squeeze on dairy farms. There are about half as many dairy farms as there were in 2003, a loss of more than 38,000 licensed operations.

But those that remain are finding ways to adapt.

A decline in sales forced Tom Murray to shut down milk production at his dairy farm in 2019. “If we could make money, we’d still be doing it,” Murray told CBS News’ Michelle Miller.

Murray had to sell off his prized heifers, including the descendants of his best, Lucinda. She set the world’s milk production record in 1997 by producing 21 gallons a day, compared to the average of about 14 gallons, he said.

“We had good cows, so to make that decision was very personal but also very needed for economic stability of this property,” said Murray.

“When we’re competing against the Walmarts and the Lowes of this world, on this size scale, we just don’t cut it. We just don’t have that scale of efficiency.”

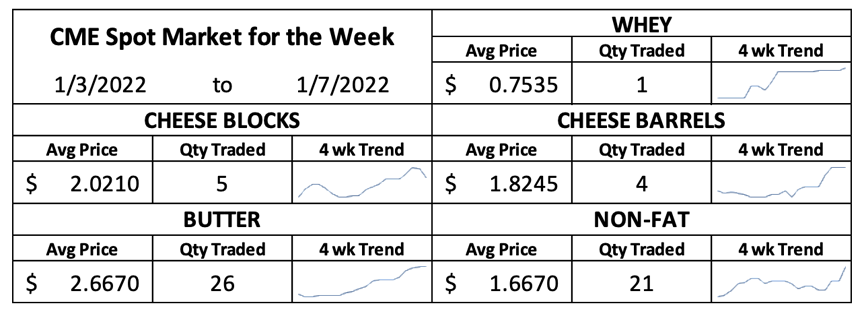

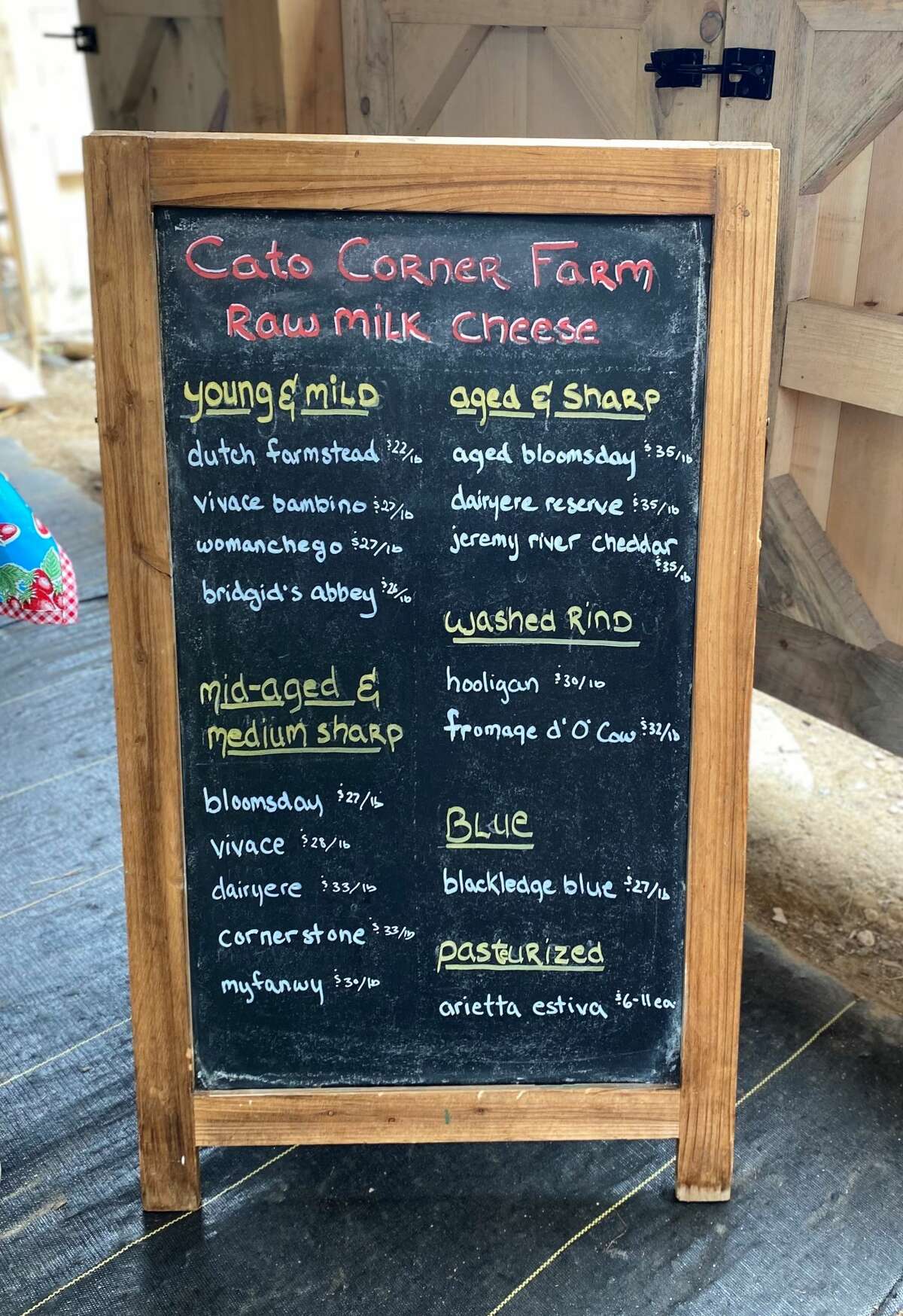

While dairy is on the decline, cheese consumption has nearly doubled over the last four decades. New York, where Murray’s farm is located, is already among the nation’s top producers and ranks No. 1 in yogurt, cottage cheese and sour cream production.

So, Murray switched his focus from milk to cheese. He owns the Muranda Cheese Company, which he has continued to expand with live music and tasting events.

“We’re trying to create a market to make our own cheese and create a destination here in the Finger Lakes. It just happens to go good with all the craft beverage facilities that are already here,” said Murray.

That’s one approach. Doug Young has another.

Young went big, increasing the number of cows at Spruce Haven Farms from 120 to 2,000.

“You have to have high levels of production, production per cow and per farm and then you can spread the cost of expertise. There are so many areas of expertise in dairy that there’s no way one person can be good at all of them,” Young said.

“Whoever’s responsible for breeding the cows or feeding the cows or taking care of sick cows, they have to be so good at it, they have to be as good as a veterinarian,” he said.

Young also joined forces with his neighbors, including Kevin Ellis, a former investment banker-turned-milkman. Ellis heads Cayuga Milk Ingredients — a co-op of 30 farmers, including Young, who banded together 13 years ago to figure out their future.

“The farmers in this region were shipping their milk as far as New York City, close to Boston, down into southern New Jersey to find milk markets,” Ellis said. “Ten percent of their gross income was going to transportation costs. That did not seem to be sustainable, so we started to envision building a plant locally to shorten the haul distance.”

That plant also helped farmers erase the middleman: They process and market their own products, and also handle research and development.

One of the solutions they found was dehydrating milk into powder to lessen its weight, which made it highly profitable.

“To give you an idea, it was costing $2.50 a hundredweight to get product to New York City. When we took the water out, we can move that same product to Shanghai for $0.67,” said Ellis.

Young’s sons, Luke and Dustin, have turned their focus on manure digestion — using manure to create power. A process they use to break down manure produces just over 500 kilowatts an hour, according to Dustin. That powers their farm and about two farms that are the same size, he said.

It accounts for a utility savings of $250,000 a year for the 4,000-acre farm — a significant reduction in the farm’s carbon footprint, which they hope one day will be net zero. Dustin said he believes this process is catching on.

“The technology is getting to a point where it makes sense for people to do,” he said. “It’s easy to do something like this when you are not carrying the entirety of the risk.”

Source: winknews.com