Global milk production surge triggers price avalanche – NZ output +8.3%, inventory crisis forces 119% auction volume spike. Your margins at risk.

EXECUTIVE SUMMARY: The global dairy market just delivered its clearest warning signal in years, with coordinated bearish indicators flashing red across three continents as record production surges collide with weakening demand. New Zealand’s explosive 8.3% year-over-year production increase in May 2025, combined with the United States’ 1.6% growth and the UK’s 5.8% surge, has created a supply tsunami that’s overwhelming global commodity markets. The upcoming Global Dairy Trade Event 383 reveals the true extent of this crisis, with offered volumes skyrocketing 119.3% for Anhydrous Milk Fat, 83.9% for butter, and 76.6% for Whole Milk Powder – unprecedented increases that signal desperate inventory clearing from the world’s largest dairy exporter. While European futures contracts have already declined 1.4% for SMP and 0.9% for butter, and GDT Pulse auctions show WMP prices crashing 3.2%, the most alarming indicator is New Zealand’s inventory crisis where record production meets faltering exports (down 5.7%), forcing a 2.5% year-over-year inventory build-up. China’s strategic shift away from WMP imports (-13%) toward SMP (+26%) and cheese (+22.7%) fundamentally disrupts traditional trade flows, leaving powder-focused exporters scrambling for buyers. Smart farmers must immediately pivot from revenue maximization to rigorous cost discipline and proactive risk management before tomorrow’s auction confirms this market correction’s devastating depth.

KEY TAKEAWAYS

- Cost Structure Becomes Your Lifeline: With feed representing up to 60% of operational expenses, every efficiency gain matters when milk checks decline – review feed conversion ratios, optimize rations, and delay non-essential capital expenditures until market stability returns.

- Component Strategy Offers Salvation: U.S. butterfat production surged 3.4% year-over-year while average butterfat tests climbed from 3.95% to 4.36% since 2020, with premium payments averaging $0.75-$1.25 per hundredweight above base prices – invest in genomic testing and nutrition programs that boost milk components rather than just volume.

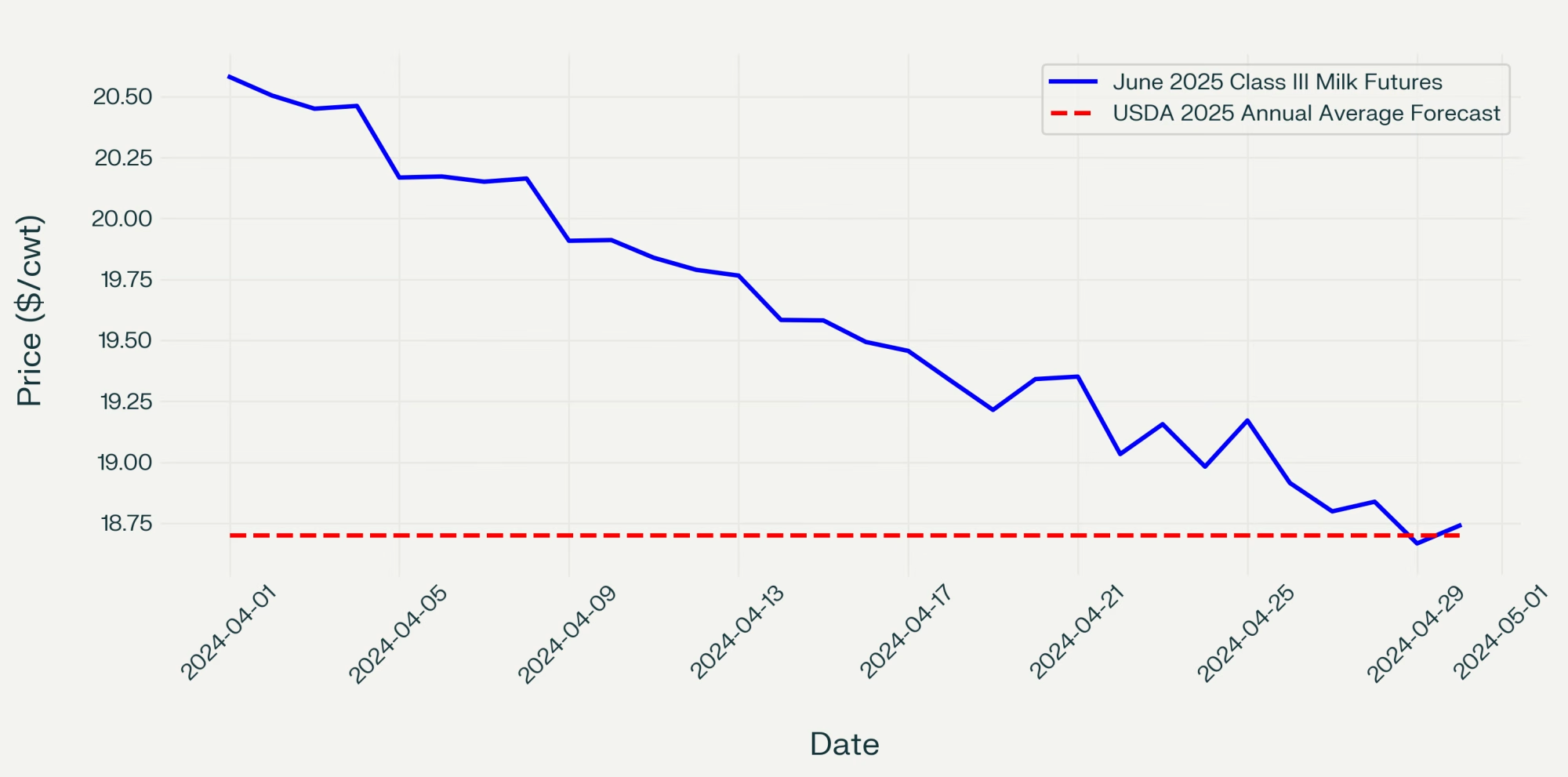

- Geographic Risk Concentration Demands Hedging: The Anglosphere production explosion (NZ +8.3%, UK +5.8%, US +1.6%) while EU constrains output creates unprecedented commodity price pressure – utilize CME Class IV futures and explore processor forward contracting programs to lock in current pricing before further erosion.

- Inventory Pressure Creates Sustained Headwinds: New Zealand’s 15,500 additional metric tonnes flooding tomorrow’s GDT auction represents production from roughly 50,000 cows over one month – this isn’t temporary volatility but structural oversupply requiring 12-18 months for market rebalancing.

- Revenue Diversification Becomes Critical: With three-quarters of U.S. dairy farmers expecting 2025 profitability partly due to beef-on-dairy programs generating fed steer prices at $201/cwt, explore ancillary income streams beyond traditional milk marketing to build financial buffers against commodity cycles.

Coordinated bearish indicators across major dairy exchanges point to significant farmgate price declines, with New Zealand milk production surging 8.3% while exports fall 5.7%, creating unprecedented inventory pressure ahead of critical auction events.

Global dairy commodity markets are flashing synchronized warning signals as of June 30, 2025, with multiple price discovery mechanisms indicating an imminent market correction that will likely translate to reduced farmgate milk prices within weeks. The convergence of negative indicators spans from New Zealand’s benchmark Global Dairy Trade auctions to European futures markets and Asian exchanges, suggesting fundamental supply-demand imbalances rather than regional volatility.

Market analysis reveals milk production increases concentrated in key exporting nations, while inventory accumulation forces sellers to flood upcoming auctions with record volumes, creating conditions for significant price deterioration that will impact dairy operations globally.

Auction Results Confirm Widespread Price Weakness

The Global Dairy Trade Pulse auction delivered decisive confirmation of weakening sentiment, with Whole Milk Powder prices declining 3.2% and Skim Milk Powder falling 2.5% from the previous trading event. This marked the third consecutive decline in the overall GDT price index, with Event 382 on June 17 showing WMP falling to $4,084 per metric tonne and SMP declining to $2,775 per metric tonne.

The weakness extends beyond New Zealand’s benchmark platform. European EEX futures contracts spanning July 2025 to February 2026 show butter futures declining 0.9% while SMP futures dropped 1.4%. Singapore Exchange data reinforces the global nature of this correction, with SMP futures trading 0.8% lower and butter contracts down 0.2%.

European spot markets validate the immediate price pressure. The official EEX butter index fell 0.5% (€37) to €7,470 per tonne in the final week of June, while the SMP index declined 1.2% (€30) to €2,400 per metric tonne.

Production Surge Creates Perfect Storm

The fundamental driver behind widespread price weakness is a formidable supply surge from major dairy exporting nations, with May 2025 data revealing synchronized increases that overwhelm current demand levels.

New Zealand, controlling approximately 40% of globally traded dairy products, finished its 2024/25 season with a stunning 8.3% year-over-year jump in May milk collections. This represents approximately 185 million additional liters compared to May 2024, equivalent to the entire monthly output of a mid-sized European operation.

United States milk production rose 1.6% year-over-year in May, continuing to push total 2025 collections up 1.1%, according to USDA data. The USDA reports the 24 major dairy states produced 19.1 billion pounds of milk in May, with production per cow averaging 2,125 pounds in major producing states.

The United Kingdom reported a substantial 5.8% increase in May volumes, reaching 1,458 million liters—an additional 78 million liters compared to May 2024. Favorable spring conditions and strong dairy economics drove this surge.

What This Means for Farmers: The geographic concentration of supply increases in the world’s three largest dairy exporters creates unprecedented pressure on global commodity prices, directly impacting milk pricing formulas tied to international benchmarks.

Inventory Crisis Forces Market Breaking Point

Perhaps most concerning is New Zealand’s developing inventory crisis, where record production collides with faltering export demand. While May production exploded 8.3% higher, New Zealand’s milk equivalent exports simultaneously fell 5.7%. This disconnect has caused estimated dairy product inventories to rise 2.5% year-over-year.

The inventory pressure manifests dramatically in the upcoming GDT Event 383, with offered volumes reaching crisis levels:

- Anhydrous Milk Fat: Up 119.3% to 4,670 metric tonnes

- Butter: Volume increased 83.9% to 2,290 metric tonnes

- Whole Milk Powder: 76.6% increase to 12,345 metric tonnes

- Skim Milk Powder: 63.6% jump to 4,200 metric tonnes

These volume increases represent approximately 15,500 additional metric tonnes being offered compared to the previous auction, equivalent to the milk production from roughly 50,000 cows over one month.

Regional Market Divergence Complicates Outlook

Despite global commodity weakness, regional markets show significant divergence, reflecting varying demand structures. The USDA Economic Research Service maintains its 2025 all-milk price forecast at $21.95 per hundredweight, up $0.35 from previous estimates, reflecting strong domestic U.S. demand rather than export commodity strength.

U.S. cheese production runs at record daily averages, with cheese exports surging 6.7% while nonfat dry milk/SMP exports fell 20.9% in April. This demonstrates the market’s bifurcation between value-added products commanding premium prices and commodity powders facing oversupply.

European production constraints offer some market balance. Germany’s milk production declined 1.8% year-over-year while the Netherlands saw a 0.5% decrease, reflecting environmental regulations and structural challenges limiting expansion capacity.

China Demand Shift Adds Market Complexity

Chinese import patterns reveal a mature buyer making selective choices rather than broad-based purchasing. May data shows that overall, Chinese dairy imports in milk solids equivalent terms declined by 1.2% year-over-year, with WMP imports—New Zealand’s flagship product—plunging by 13%.

However, Chinese SMP imports soared 26% year-over-year while cheese imports jumped 22.7%, indicating structural demand shifts favoring EU and U.S. suppliers over New Zealand’s powder-focused export strategy.

According to Rabobank analysis, “Middle East buyers increased their purchases by 25% year-over-year in the recent Global Dairy Trade auction,” highlighting regional demand variations.

Technology Integration Masks Underlying Volatility

Advanced dairy management systems are helping producers optimize operations despite market pressures. Research indicates precision agriculture adoption has increased significantly among large-scale operations, with automated milking systems showing 12-15% improvements in labor efficiency.

Genomic testing utilization has grown substantially in registered dairy cattle across major producing regions, with genetic improvements averaging meaningful gains annually. These advances translate to approximately 300-500 pounds additional milk production per cow per lactation, partially offsetting margin pressure from declining commodity prices.

Component Focus Drives Strategic Shifts

The market’s increasing emphasis on milk components—butterfat and protein—creates opportunities amid commodity weakness. U.S. butterfat production surged 3.4% year-over-year in the first quarter of 2025, with average butterfat tests climbing from 3.95% in 2020 to 4.36% by March 2025.

Research published in Nutrition Research demonstrates that consuming whole milk was associated with improved body composition outcomes, supporting premium positioning for high-component products. Premium payments for high-component milk average $0.75-$1.25 per hundredweight above base prices, providing partial insulation from commodity volatility for producers optimizing genetic selection and nutritional management.

Market Outlook and Industry Implications

Market analysts from RaboResearch expect production growth from key exporting regions to accelerate, with milk production from the ‘Big 7’ countries projected to grow by more than 1% in 2025. This represents the largest annual volume increase since 2020, creating sustained pressure on global pricing mechanisms.

However, demand uncertainty remains elevated. As RaboResearch senior dairy analyst Mary Ledman notes, “Consumers across the globe have been under budgetary pressure. Retail dairy prices have been mixed around the world”.

The Latest

Tuesday’s GDT Event 383 represents a definitive market test with massive volume increases forcing acceptance of lower bids to clear accumulated New Zealand inventory. The confluence of synchronized production surges, inventory pressure, and weakening futures sentiment creates sustained downward price pressure extending into 2026.

Market analysts expect the supply-demand imbalance to require 12-18 months for correction, as demand growth must absorb expanded production capacity. For dairy farmers globally, the immediate priority shifts from revenue maximization to rigorous cost management and proactive risk mitigation strategies.

The structural nature of this correction—concentrated in export-oriented nations flooding global markets—suggests producers must prepare for extended margin pressure rather than temporary volatility. Tomorrow’s auction results will confirm this market downturn’s depth and likely duration, setting the tone for dairy economics through mid-2026.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- CME Dairy Market Report June 24th, 2025 – Cheese Market Crash Delivers Another Margin-Crushing Blow – Provides tactical risk management strategies and immediate hedging tools to protect against Class III crashes below $17/cwt, including specific Dairy Revenue Protection implementation guidance for crisis scenarios.

- USDA’s 2025 Dairy Outlook: Market Shifts and Strategic Opportunities for Producers – Reveals strategic positioning methods for navigating production constraints and component optimization opportunities, demonstrating how to align with processor demands for long-term profitability despite market turbulence.

- The Future of Dairy Farming: Embracing Automation, AI, and Sustainability in 2025 – Explores cutting-edge technologies that can offset margin pressure through efficiency gains, showcasing practical automation solutions that deliver measurable ROI during challenging commodity cycles.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!