While mega-dairies grabbed headlines, small farmers quietly hijacked beef genetics – creating a stealth revolution corporate giants never saw coming.

The dairy establishment missed it completely. While industry leaders were busy building mega-dairies and multinational processing plants, America’s dairy farmers quietly changed the genetic foundation of their industry. In just five years, beef-on-dairy has exploded to 7.9 million semen units annually – now breathing down the neck of gender-selected dairy semen as the dominant breeding choice in U.S. dairy herds. This isn’t just a breeding trend; it’s an agricultural insurgency creating an unexpected lifeline for the family farms that industry consolidation was supposed to eliminate.

BREEDING BOMBSHELL: 7.9 Million Reasons Small Farmers Are Winning

The scale of this transformation is undeniable. According to the National Association of Animal Breeders (NAAB), domestic beef semen sales hit a new high of 9.4 million in 2023, marking the sixth year of record sales. Of those, 7.9 million units were used in dairy herds – up nearly 1 million from the previous year.

“In just five years, beef-on-dairy has exploded from a niche practice to 7.9 million semen units annually – representing a fundamental shift in how America’s dairy farmers approach breeding decisions.”

This represents a complete reshaping of dairy breeding practices.

| Semen Category | 2023 Units (millions) | Market Position | Trend |

| Gender-Selected Dairy | 8.4 | #1 Position | Stable leader |

| Beef-on-Dairy | 7.9 | #2 Position | ↑ 1 million units from previous year |

| Conventional Dairy | 7.0 | #3 Position | Declining |

| Heterospermic Beef* | 1.8 (1.3 domestic) | #2 Among beef breeds | Emerging category |

*Second largest ‘breed’ of beef semen sold, following only Angus

Gender-selected dairy semen now leads with 8.4 million units, followed closely by beef-on-dairy at 7.9 million units, with conventional dairy semen falling to third place at 7 million units. Less than a decade ago, in 2015, the all-time high for beef semen sales was just 2.5 million units.

Perhaps most telling is the emergence of heterospermic beef products – a mixture of multiple sires in a single straw – which has become the second largest “breed” of beef semen sold at 1.8 million units (with 1.3 million domestic sales), trailing only Angus. This innovative approach allows producers to maximize genetic diversity while maintaining the beef-on-dairy advantage.

FROM PARLOR TO PROFIT: The Edenfield Family’s Successful Transition

Logan Edenfield knows firsthand the challenges and opportunities of transitioning from dairy to beef. He grew up on a 50-cow dairy operation in Ohio that successfully made the switch to beef production. Edenfield now shares his expertise with Equity Livestock in Stratford.

“Farmers exiting dairy and going into beef must change their thinking,” Edenfield explains. His family’s approach focused on strategic breeding decisions that maximized calf value while creating a clear timeline for the transition. “Those still milking cows and looking to retire should breed everything to an Angus bull, which will result in black-hided calves that tend to be worth the most,” he advises. “Then, you automatically have put a date on when you won’t have replacement heifers. It gives you a deadline and, in the meantime, gets you more value out of the calves you are selling.”

The Edenfield family discovered that timing is everything. “Sell those calves at 3 to 5 days of age to reap the most benefit,” Logan recommends based on his family’s experience. This approach minimizes input costs while capitalizing on the significant price premium for beef-cross calves. While conventional Holstein bull calves might bring just $60 at the market, black beef-cross calves from Holstein dams can command $100 to $300 – a value proposition transforming his family’s operation during the transition period.

SMALL FARM REVENGE: Outflanking Corporate Giants With Crossbred Efficiency

The performance metrics of beef-on-dairy crosses create the perfect foundation for former dairy farmers to establish profitable, small-scale finishing operations. Texas Tech University research confirms that the average daily gain and feed-to-gain ratio of crossbreds is significantly better than that of Holsteins and is similar to that of conventional beef cattle.

For small-scale producers, these efficiency gains translate directly to profitability. Crossbred finishing times are about 20% faster than Holsteins, which means these animals produce the same beef in a shorter timeframe and on less total feed. This efficiency creates the perfect scenario for former dairy farmers with limited facilities and labor.

“Crossbred finishing times that are about 20% faster than Holsteins create the perfect scenario for former dairy farmers with limited facilities and labor – delivering the same beef in less time with lower input costs.”

What makes these crossbreds particularly suited for minor operations is their temperament. Having been bottle-raised in the dairy system, beef-on-dairy calves are typically docile and easy to handle – eliminating the need for extensive handling facilities or specialized equipment. For retired farmers or those balancing off-farm employment with farming, this management reality is dramatically different from conventional beef production.

ECONOMIC REALITY CHECK: The Numbers Behind The Transition

Understanding the financial implications is essential for dairy farmers considering a transition to beef production. A comparative analysis of continuing dairy production versus transitioning to beef-on-dairy reveals compelling differences:

| Factor | Staying in Dairy | Transitioning to Beef-on-Dairy |

| Initial Investment | Ongoing facility upgrades ($500-1,500 per stall) | Minimal conversion costs ($100-300 per head capacity) |

| Labor Requirements | 40-60 hours/week (50-cow herd) | 10-15 hours/week (same facilities) |

| Return Timeline | Immediate but thin margins | 12-18 months to first finished cattle |

| Profit Margin Potential | $1.50-$2.50/cwt milk | $300-$600/head (direct marketed) |

According to farm financial consultants at Cornell PRO-DAIRY program, transitioning dairy facilities to beef production typically requires minimal investment when existing infrastructure is utilized. Their analysis suggests that the decreased labor requirements alone can make the transition attractive for farmers nearing retirement or seeking off-farm employment.

The University of Wisconsin Center for Dairy Profitability notes that while dairy provides immediate cash flow, beef production offers significantly reduced stress levels and labor flexibility that many former dairy farmers find equally valuable. Their research indicates that the lower input costs and facilities investment required for beef production can deliver higher returns on assets, particularly for small-scale operations that develop direct marketing channels.

EXTENSION EXPERTISE: What The Specialists Are Saying

The growing interest in beef-on-dairy has caught the attention of agricultural extension services. Ryan Sterry, UW-Extension agriculture agent for St. Croix County, has observed the trend firsthand. “It’s getting to be a more popular topic for us,” Sterry notes, pointing to increasing attendance at workshops titled “So You Want to Raise Beef?” in dairy-heavy regions.

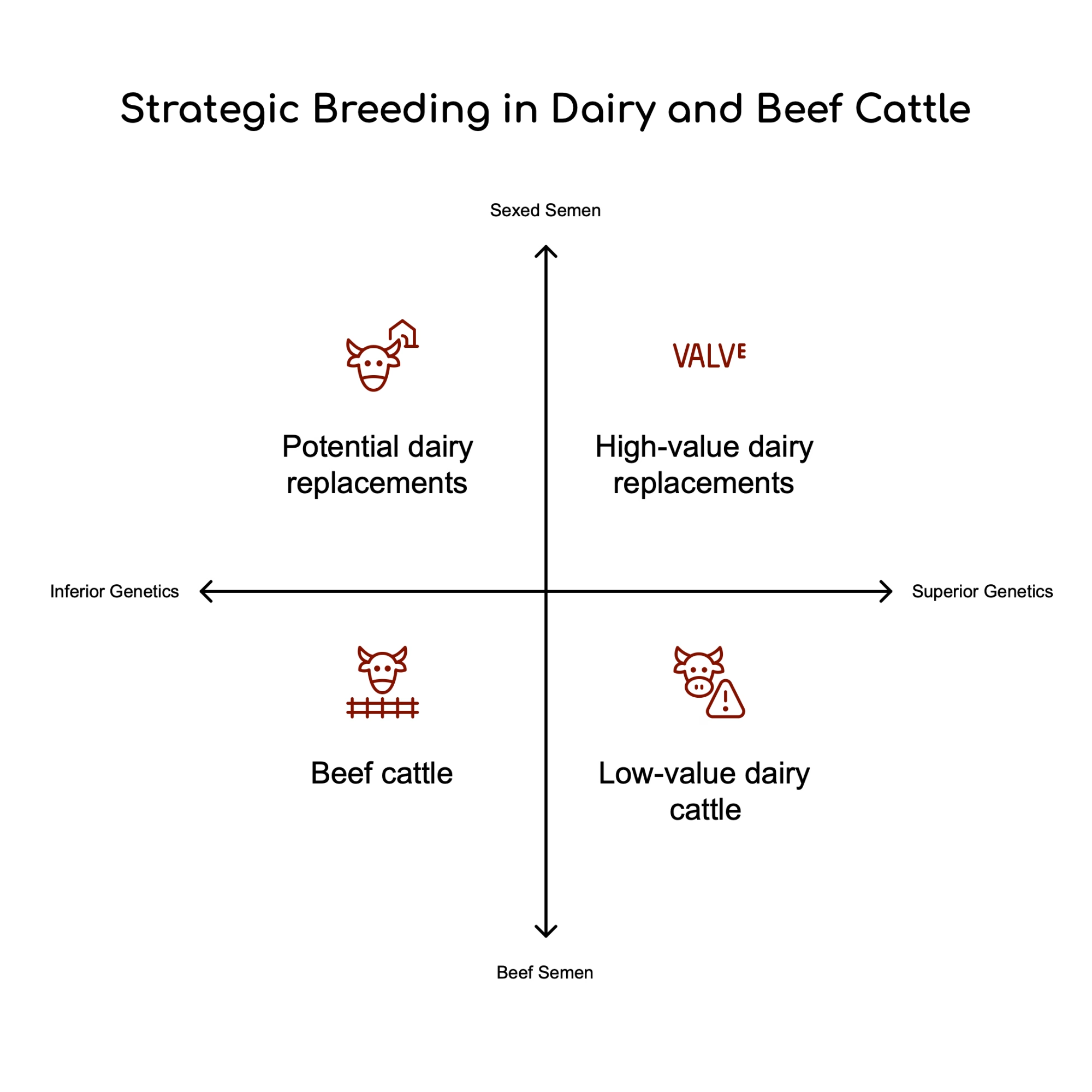

Scott Ellevold of NorthStar Select Sires, who also raises beef cattle north of New Richmond, has witnessed this shift from the genetic supplier side. “Not only are more people breeding their whole herd over to beef as they exit dairy altogether, but many dairy farmers are breeding their best cows with sexed semen to increase their odds of getting heifer calves that will grow into replacement animals and their lower-end cows to beef bulls,” Ellevold explains.

This strategic approach – using genomic testing to identify superior heifers for dairy replacements while applying beef semen to genetically inferior animals – maximizes the value of each pregnancy. It contradicts traditional advice but accelerates genetic progress by ensuring only top genomic animals produce dairy replacements.

PROFIT PIPELINE: How Small Producers Cut Out Middlemen

While large industry players chase incremental efficiency improvements, former dairy farmers around urban centers sell beef directly to consumers at premiums that would make a corporate accountant’s head spin. These producers aren’t competing on efficiency but on story, transparency, and relationship.

The direct-marketing model typically involves consumers purchasing a whole, half, or quarter animal, which is then processed at a small local slaughterhouse. This approach eliminates multiple intermediaries, allowing producers to capture a significantly higher percentage of the end consumer dollar while delivering what consumers increasingly demand: knowing exactly how their food was raised.

This vertical integration model – from calf to consumer – represents the antithesis of the industry’s push toward specialized, fragmented production models. Family farmers are discovering they can generate higher margins with fewer animals by controlling more of the value chain.

REGIONAL OPPORTUNITIES: Location Matters In The Beef-on-Dairy Game

The beef-on-dairy opportunity isn’t distributed equally across all regions. According to data from the USDA’s Economic Research Service and the Niche Meat Processor Assistance Network, certain areas offer distinct advantages for farmers pursuing this transition:

Northeast & Mid-Atlantic

These regions benefit from the country’s highest concentration of small USDA-inspected processors, with New York, Pennsylvania, and Vermont leading in facilities per capita. Additionally, the Northeast features densely populated urban areas with high consumer incomes and strong interest in local food, creating premium direct marketing opportunities. According to Cornell Cooperative Extension research, direct-marketed beef commands 15-30% higher prices in this region than conventional channels.

Upper Midwest

Wisconsin, Minnesota, and Michigan combine strong processing infrastructure with dairy farming expertise. The University of Wisconsin Center for Dairy Profitability highlights that these states have maintained more small to mid-sized slaughter facilities than other regions. The Wisconsin Farmers Union notes that the cultural heritage of meat processing in these areas creates infrastructure and consumer awareness advantages for small-scale beef producers.

Challenges in Other Regions

Western and Plains states face significant processing bottlenecks, with USDA data showing fewer small-scale processors per cattle producer. According to University of Georgia research, Southern states generally have lower direct marketing premiums, though urban markets like Atlanta, Nashville, and Charlotte buck this trend with strong local food movements.

PREMIUM ADVANTAGE: The Quality Edge Big Beef Can’t Match

Initial research by Texas Tech University indicates hybrid cattle produce more and higher-quality beef products without impacting milk production efficiency compared to purebred dairy calves. This quality advantage creates a compelling narrative for direct marketing: premium eating experiences from small-scale, locally raised animals.

Lisa Pederson, North Dakota State University beef quality assurance specialist, notes that “dairy steers are well known for their ability to produce the highest quality grades of beef (Prime and High Choice).” This quality potential gives former dairy farmers a significant marketing advantage when positioning their beef-on-dairy crosses in premium direct markets.

These aren’t just marketing claims – beef-on-dairy crosses deliver superior meat quality in critical consumer metrics. The research shows these crossbreds appear to inherit their Holstein ancestors’ marbling capability but finish faster, creating the perfect foundation for premium marketing messages that small producers can leverage in direct-to-consumer channels.

DAVID VS. GOLIATH: The Economic Numbers Don’t Lie

For former dairy farmers, the economics present a stark contrast to conventional commodity production:

| Production Model | Advantages | Economic Impact |

| Conventional Commodity | Scale efficiency | Thin margins, high volume required |

| Beef-on-Dairy Direct | 20% faster finishing Lower capital requirements Premium direct marketing | Higher margins Viable at smaller scale Control of value chain |

When marketed directly to consumers, these producers can capture premiums that commodity channels cannot match. This approach transforms a marginal enterprise in conventional marketing channels into a highly profitable specialty business.

CORPORATE SCRAMBLE: Industry Giants Playing Catch-Up

The remarkable success of this grassroots movement hasn’t gone unnoticed forever. Industry giants scramble to understand and capitalize on what small producers have already discovered. Cargill has launched a three-year “Dairy Beef Accelerator” program in collaboration with industry partners, including Nestlé, to research the benefits of cattle crossbreeding.

Initial research from this corporate-led initiative confirms what small producers already know: “beef on dairy” calves exhibit greater feed efficiency, which lowers greenhouse gas emissions while producing more and higher-quality beef products.

“Achieving the most from the valuable resources used in beef production is a key part of Cargill’s BeefUp Sustainability initiative,” notes the company – an implicit acknowledgment that this model represents a fundamental shift in how beef production can be structured.

The question is whether small producers can establish their market position before corporate interests attempt to scale and commoditize the approach.

“While corporate agriculture spent decades telling small farmers to ‘get big or get out,’ those same farmers discovered a market opportunity that big players missed entirely – and now industry giants are scrambling to understand what small producers already know.”

NAVIGATING REAL CHALLENGES: Beyond The Hype

Despite its promise, this model faces several significant challenges that farmers must address:

1. Processing Access Bottleneck

Small-scale beef producers face a critical infrastructure challenge: limited access to USDA-inspected slaughter facilities. The consolidation of meat processing has left many rural areas without local plants capable of handling direct-to-consumer orders. This bottleneck can create scheduling delays of 6-12 months at some facilities, making consistent supply difficult for producers selling directly to consumers.

2. Residue Management Requires Vigilance

Lisa Pederson of North Dakota State University warns that residue management requires particular attention when transitioning dairy animals to beef production. “Dairy cows had a residue violation rate nine times higher than beef cows,” she notes, highlighting that about 20% of violating dairy carcasses tested positive for more than one product residue. Former dairy farmers must implement strict withdrawal protocols and maintain meticulous records to avoid costly violations.

3. Market Saturation Concerns

As more dairy operations adopt beef-on-dairy breeding strategies, the market could become saturated with crossbred animals. This potential oversupply could erode the price advantage enjoyed by beef-cross calves, which Edenfield noted was $100-300 versus just $60 for straight Holstein calves. Producers entering this space must develop marketing strategies differentiating their product beyond simply being a beef-dairy cross.

4. Consumer Price Sensitivity

While direct marketing offers premium prices, consumer willingness to pay these premiums may fluctuate with economic conditions. Direct marketers must constantly demonstrate value through quality, storytelling, and relationship-building to maintain price points that make their business model viable. This requires marketing skills and customer service that differ significantly from conventional dairy production.

5. Capital Requirements For Transition

Adapting existing dairy facilities for beef finishing often requires capital investments at a time when many existing dairy farmers face financial constraints. Strategic phasing of the transition and carefully selecting which modifications to prioritize are essential for managing this challenge.

SUSTAINABILITY DOUBLE WIN: Economic and Environmental Gains

Recent research on beef-on-dairy systems reveals a compelling sustainability story beyond economics. A 2024 case study published in Semantic Scholar titled “Beef on dairy: A case study of sustainable animal protein production” highlights how these production systems provide both economic sustainability for producers and environmental benefits for society.

“Human society has evolved over thousands of years, but in the last 35 years, we have gained access to multiple advanced technologies that can change how animal protein is produced,” the researchers note. “For the producers of animal protein, it is the economic sustainability of the farmer producers. For the consumers of animal proteins, it is the production of that protein in a manner that derives in a highly nutritious product produced in an environmentally friendly system.”

This dual sustainability – supporting farmer livelihoods while improving environmental performance – creates a powerful narrative for positioning beef-on-dairy products in today’s values-driven marketplace.

THE TIME IS NOW: Your Roadmap to Beef-on-Dairy Success

The beef-on-dairy revolution is happening with or without you. For former dairy farmers or those considering an exit from dairy production, the window of opportunity won’t remain open indefinitely. Here’s how to determine if this path is right for your operation and how to get started:

Action Steps for Dairy Farmers:

- Contact your regional extension office about beef production workshops – University extension services across dairy states are responding to increased interest with targeted education programs

- Research local processing options and their waitlists – Secure processing access before investing in finishing facilities by contacting USDA-inspected processors in your area

- Consider genomic testing to identify lowest-merit dairy animals – Strategically apply beef semen to animals with lower genetic merit for dairy traits.

- Connect with direct marketing networks in your region – Resources like the National Farmers Market Directory can help identify local marketing opportunities.

- Investigate USDA Value-Added Producer Grants – These programs fund farmers transitioning to value-added enterprises like direct-marketed beef.

Questions to Ask Before You Start:

- Processing Access: Are USDA-inspected facilities available within a reasonable distance?

- Market Potential: Is there sufficient local demand for direct-marketed beef?

- Facility Adaptability: How easily can existing dairy facilities be adapted for beef production?

- Cash Flow Bridge: Can you manage the transition period before beef income begins?

- Marketing Skills: Do you have the skills or partnerships needed for direct marketing?

The rise of beef-on-dairy represents more than just a profitable niche – it’s a potential pathway to resurrect thousands of small family farms pushed out of dairy production by consolidation. While industry giants fixate on massive production systems, the humble crossbred steer quietly creates an alternative path that leverages America’s former dairy farmers’ knowledge, facilities, and grit.

The question isn’t whether this model works – the data clearly shows it does. The question is whether enough former dairy farmers will seize the opportunity before corporate interests attempt to scale and commoditize the approach. For those who do, it represents perhaps the most promising pathway to resurrect small-scale livestock production in an era of relentless consolidation – and reclaim their place in an industry that once left them behind.

Key Takeaways

- Strategic breeding decisions create clear transition paths – breeding lower-genetic-merit dairy animals to beef bulls captures immediate calf value premiums ($100-300 vs $60 for Holstein bulls) while establishing a timeline for a complete transition out of dairy.

- Regional advantages matter. The Northeast and Upper Midwest regions offer superior processing infrastructure and stronger direct-marketing opportunities, with processing access being the critical factor in a successful transition.

- Minimal investment, maximum leverage – Existing dairy facilities can be adapted for beef production at 1/5 the cost of new construction, with labor requirements reduced from 40-60 hours weekly to just 10-15 hours for comparable herd sizes.

- Docility creates management advantages – Beef-on-dairy crosses retain the temperament of bottle-raised dairy calves, eliminating the need for specialized handling equipment while providing quality grades that frequently reach Prime and High Choice.

- Direct marketing captures the premium – By selling directly to consumers through whole, half, or quarter animal purchases, former dairy farmers can maintain viable margins on smaller herds while telling a compelling local food story.

Executive Summary

America’s dairy farmers have orchestrated a remarkable shift in breeding practices, with beef-on-dairy semen usage skyrocketing to 7.9 million units annually and becoming the second most common breeding choice in U.S. dairy herds. This transition offers former dairy farmers a unique opportunity to leverage existing facilities and expertise with minimal modifications while benefiting from crossbreds that finish 20% faster than purebred Holsteins and produce higher-quality beef. By selling directly to consumers, small producers can capture premium prices that commodity channels cannot match, particularly in regions with strong processing infrastructure like the Northeast and Upper Midwest. The economic advantages are compelling – reduced labor requirements, lower capital investment, and potentially higher margins than conventional dairy – but the window of opportunity may narrow as corporate interests catch up to what small farmers discovered first. For dairy farmers considering exit strategies or diversification, beef-on-dairy represents a proven pathway to resurrect small family farms pushed aside by industry consolidation.

Download “The Ultimate Dairy Breeders Guide to Beef on Dairy Integration” Now!

Download “The Ultimate Dairy Breeders Guide to Beef on Dairy Integration” Now!

Are you eager to discover the benefits of integrating beef genetics into your dairy herd? “The Ultimate Dairy Breeders Guide to Beef on Dairy Integration” is your key to enhancing productivity and profitability. This guide is explicitly designed for progressive dairy breeders, from choosing the best beef breeds for dairy integration to advanced genetic selection tips. Get practical management practices to elevate your breeding program. Understand the use of proven beef sires, from selection to offspring performance. Gain actionable insights through expert advice and real-world case studies. Learn about marketing, financial planning, and market assessment to maximize profitability. Dive into the world of beef-on-dairy integration. Leverage the latest genetic tools and technologies to enhance your livestock quality. By the end of this guide, you’ll make informed decisions, boost farm efficiency, and effectively diversify your business. Embark on this journey with us and unlock the full potential of your dairy herd with beef-on-dairy integration. Get Started!

Learn More

- How Beef-on-Dairy Crossbreeding Delivers 200% ROI

- Why Dairy Farmers Are Turning to Beef-on-Dairy: A Game-Changer in Beef Production

- Maximize Your Dairy Farm’s Profits: Is Raising Beef on Dairy the Next Big Step

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!