Find out which AI company is the leader in dairy cattle genetics. Compare the top sires and see who really dominates the industry. Who has the most power in this genetic competition?

A long time ago in a galaxy not so far away, the fate of dairy cattle genetics was firmly in the hands of farmers and breeders. Today, the balance of power has shifted dramatically. Artificial Insemination (AI) companies now command unrivaled control over the genetic future of dairy herds worldwide. Much like the interstellar battles in Star Wars, these AI giants wield incredible influence, shaping the destiny of dairy cattle and the dairy industry. But one question remains: Who holds the most power among these titans?

As these companies duel with pedigree charts in one hand and genomic test results in the other, the landscape of dairy cattle genetics has become a battleground for supremacy. Each AI company claims to have the best sire lineups. Like the legendary clashes between the Sith and the Jedi, only one can truly dominate the genetic universe. So, let’s embark on this journey to uncover which AI company reigns supreme.

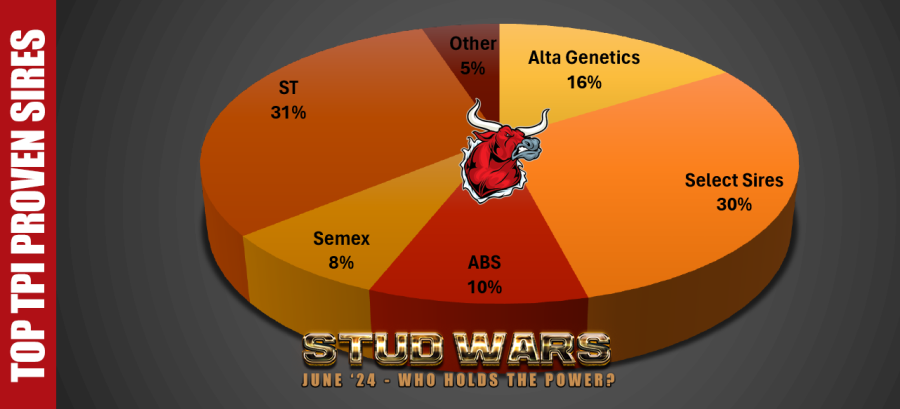

TPI

| URUS | Select Sires | ABS | Semex | STgen | Other | |

| Proven TPI | 16 | 30 | 10 | 8 | 31 | 5 |

| Genomic TPI | 9 | 32 | 4 | 24 | 20 | 11 |

| TPI | 25 | 62 | 14 | 32 | 51 | 16 |

Select Sires holds the largest market share at 31%, featuring a well-balanced group of both proven and genomic sires. Hot on their heels is STgen with a 25.5% share, boasting the strongest proven sire TPI lineup. Semex completes the top studs with a 16% market share, driven by an impressive genomic sire lineup.

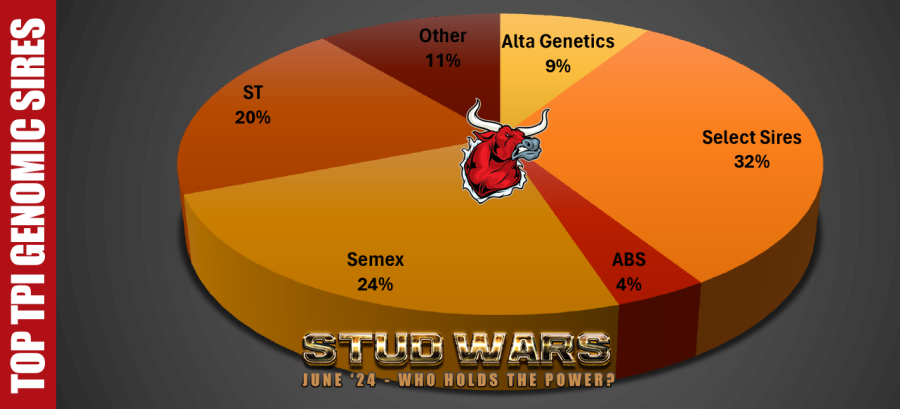

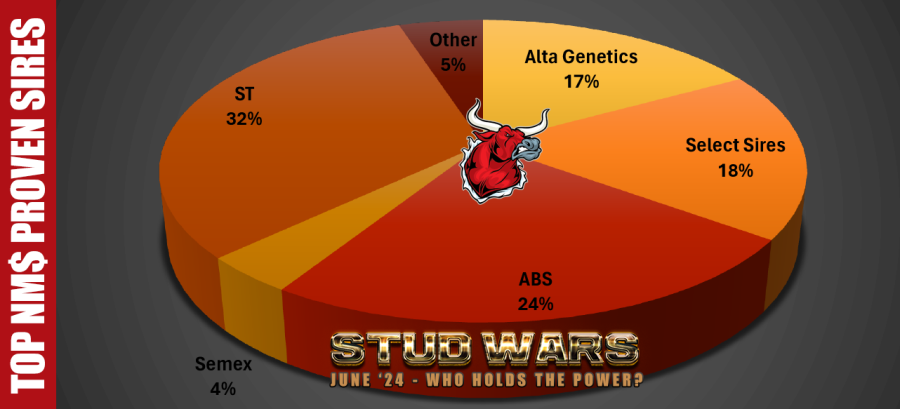

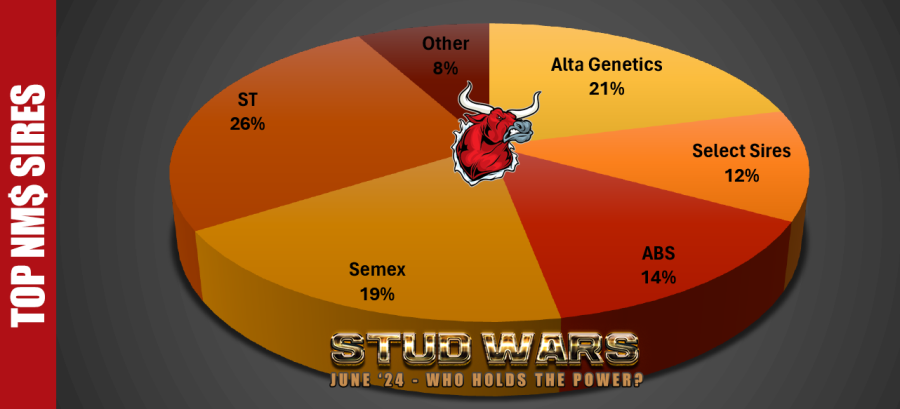

NM$

| List | URUS | Select Sires | ABS | Semex | STgen | Other |

| Proven NM$ | 17 | 18 | 24 | 4 | 32 | 5 |

| Genomic NM$ | 25 | 6 | 4 | 34 | 20 | 11 |

| NM$ | 42 | 24 | 28 | 38 | 52 | 16 |

STgen shows impressive strength with a 26.5% share of top NM$ sires. Meanwhile, URUS steps up with a robust NM$ lineup, claiming 21% of the top sires. Rounding out the top, Semex holds a solid 19% and a very strong genomic NM$ sire lineup.

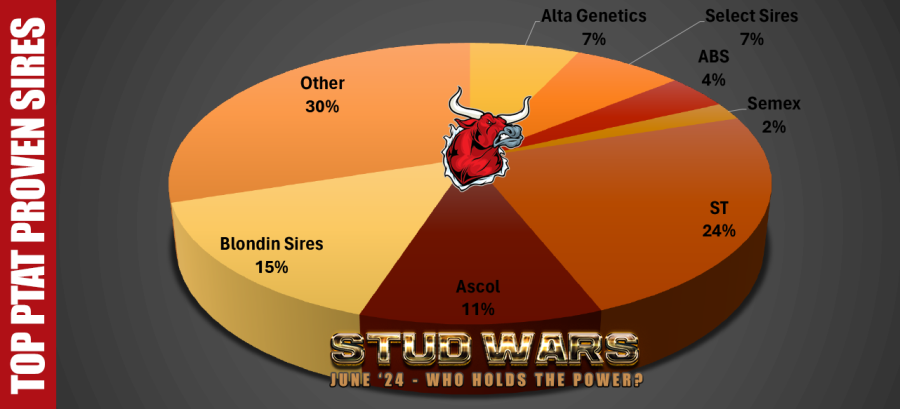

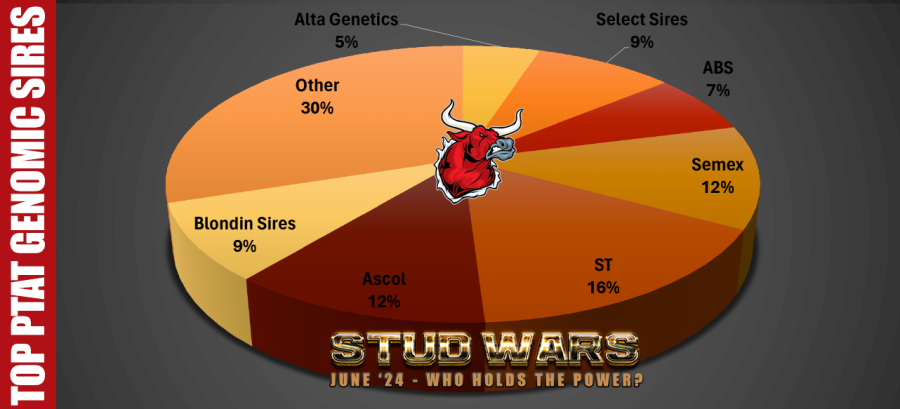

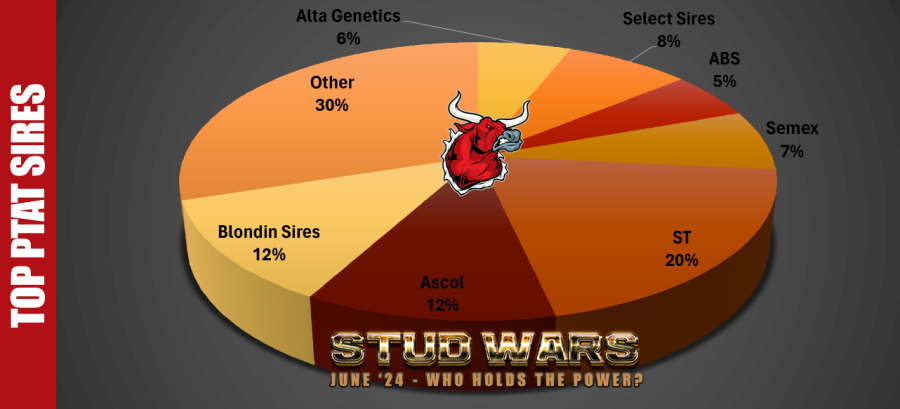

PTAT

| URUS | Select Sires | ABS | Semex | ST | Ascol | Blondin Sires | Other | |

| Proven PTAT | 7 | 7 | 4 | 2 | 24 | 11 | 15 | 30 |

| Genomic PTAT | 5 | 9 | 7 | 12 | 16 | 12 | 9 | 30 |

| PTAT | 12 | 16 | 11 | 14 | 40 | 23 | 24 | 60 |

STgen leads the PTAT rankings with a commanding 20% market share, showcasing a robust lineup of proven sire PTATs. Next is the specialist AI stud Blondin Sires, which boasts the second strongest lineup, combining both proven and genomic lists, capturing a 12% share. Completing the top three, Ascol holds a 12.5% share, demonstrating its impressive offerings.

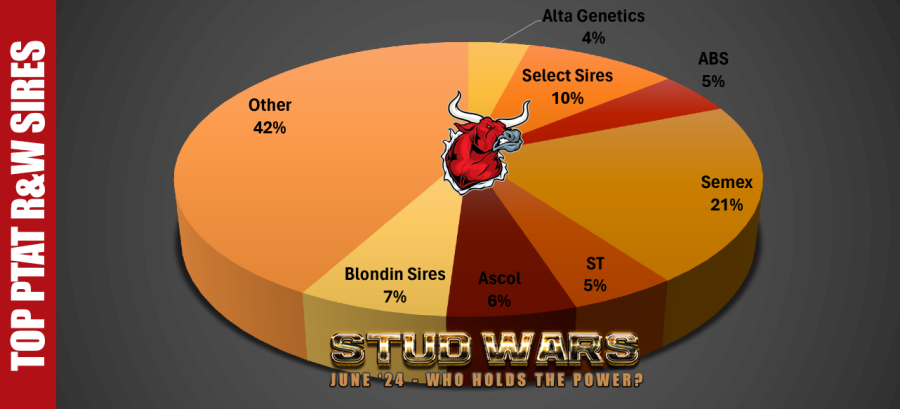

Red & White

| Alta Genetics | Select Sires | ABS | Semex | ST | Ascol | Blondin Sires | Other | |

| Red & White | 4 | 10 | 5 | 21 | 5 | 6 | 7 | 42 |

When it comes to the most diverse list of top Red & White PTAT sires, Semex takes the lead with 21% of the top sires. Right behind them are Select Sires with 10% and ST with 13%.

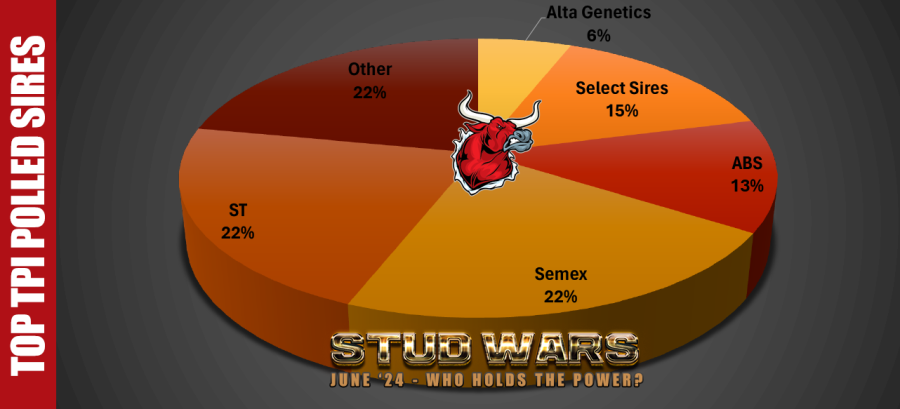

Polled

| Alta Genetics | Select Sires | ABS | Semex | ST | Other | |

| Polled | 6 | 15 | 13 | 22 | 22 | 22 |

Similar to the Red & White list, the top 100 polled sires feature a diverse range of ownership. A notable shift from the past is that major AI companies have now significantly strengthened their lineups. Semex and ST each command 22%, closely followed by Select Sires at 15%.

Genomic Sire Lineup

| Alta Genetics | Select Sires | ABS | Semex | ST | Other |

| 49 | 72 | 33 | 113 | 83 | 155 |

When it comes to the major players in the genomic sire market, Semex undeniably takes the lead, boasting a formidable 22% of the top genomic sires. Trailing behind them is STgen with 16%, and Select Sires at 14%. This marks a significant shift from our previous analysis when Select Sires held the top position with 19%, followed by ABS Global at 18%, and STgen at 14%. Semex has clearly upped their game, immensely strengthening their genomic lineup.

Proven Sire Line Up

| Alta Genetics | Select Sires | ABS | Semex | ST | Other |

| 40 | 55 | 38 | 14 | 87 | 66 |

In the proven sires’ category, STgen is leading the pack, boasting 29% of the top sires. Trailing behind, Select Sires holds an 18% share, while Alta Genetics and ABS are tied at 13%. It’s also worth noting that Semex, with a 5% share, explains why they have been focusing heavily on genomic sires to revamp their overall lineup.

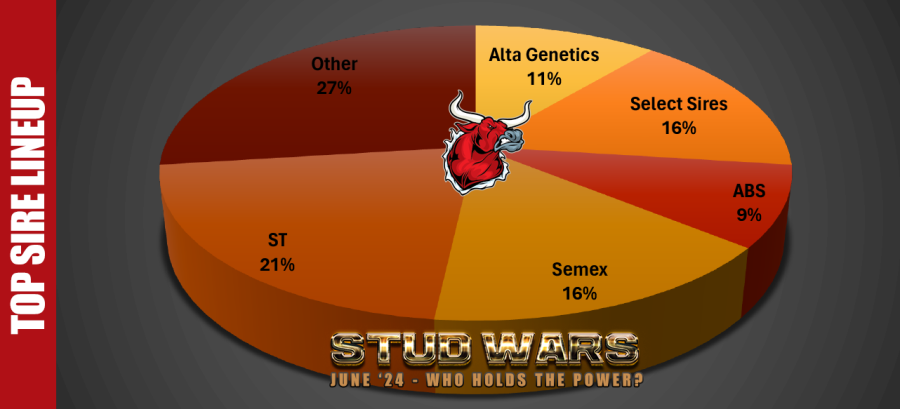

Overall Line Up

| Alta Genetics | Select Sires | ABS | Semex | ST | Other |

| 89 | 127 | 71 | 127 | 170 | 216 |

STgenetics leads the pack with a commanding 21% share of the top sires. Their robust genomic and proven lineup underscores the value of ongoing investment in superior genetics. Tied for second place are Select Sires and Semex, each holding 16% of the top sires with 127 entries apiece. Despite arriving at the same percentage, they employ markedly different strategies. Semex has ramped up their genomic investments to compensate for a relatively weaker proven lineup compared to their competitors. Interestingly, our analysis reveals a significant shift in the last couple of years. ABS, previously holding an 18% share, now only 9%. Meanwhile, Ascol and Blondin Sires have each doubled their market share from 2% to 4%.

The Bottom Line

The genetics universe of dairy cattle is vast and continuously evolving. Our journey through the galaxies of TPI, NM$, PTAT, Red & White, Polled, Genomic, and Proven Sire Lineups has revealed the power dynamics of the major players and the emergent contenders. STgen, Semex, ABS Global, and the Select Sires federation remain strong forces, innovating and adapting their strategies to maintain dominance. Meanwhile, new entrants like Blondin Sires and Ascol are trying to shake the status quo, offering tantalizing glimpses of the future.

As you navigate the cosmic landscape of dairy cattle genetics, the key takeaway is balancing both proven and genomic sires. Keeping an eye on emerging trends, understanding the strengths and weaknesses of each player, and making informed decisions will steer your herd toward stellar success. The universe may be unpredictable, but you can chart a course toward prosperity with the right choices. May the force of informed decision-making be with you!

Summary: The landscape of dairy cattle genetics is evolving rapidly, with major players like STgen, Select Sires and Semex, and new entrants such as Blondin Sires and Ascol making significant strides across various segments. While traditional metrics like TPI and NM$ still hold weight, the focus on specialized categories such as Red & White, Polled, and genomic sires shows a dynamic shift towards more targeted breeding strategies. Companies like Validity Genetics are carving out notable shares, particularly in the genomic Polled segment, indicating a competitive and diverse market. This evolving competition among Artificial Insemination companies highlights the increasing importance of niche segments and innovative genetic offerings, reshaping the power dynamics in the dairy cattle genetics universe.