The world has been battling one of the greatest viruses to ever hit man and now, just like the battle with Covid-19, the war between the Artificial Organizations has heated up to epic proportions. What started as The Battle for A.I. Supremacy back in July 2013, has seen many changes in the power struggle when it comes to sire lineups. Many of the smaller A.I. units have been purchased by larger genetic players, and the rate of change has accelerated considerably. Let’s see who has come out on top this year and who has fallen behind in the genetics race.

TPI

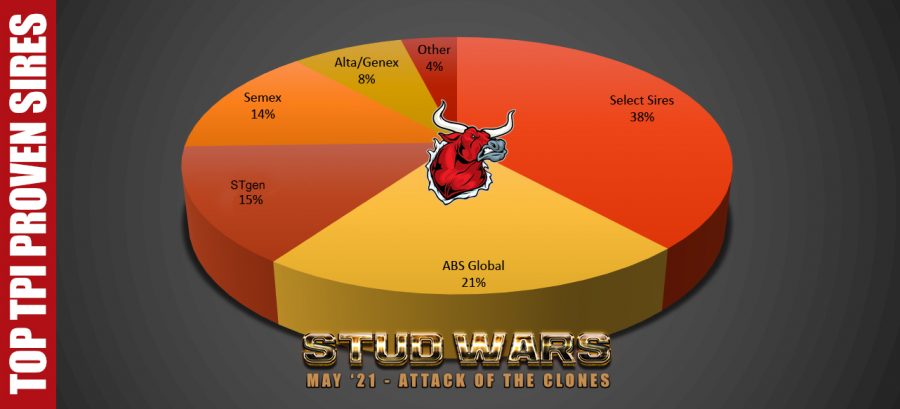

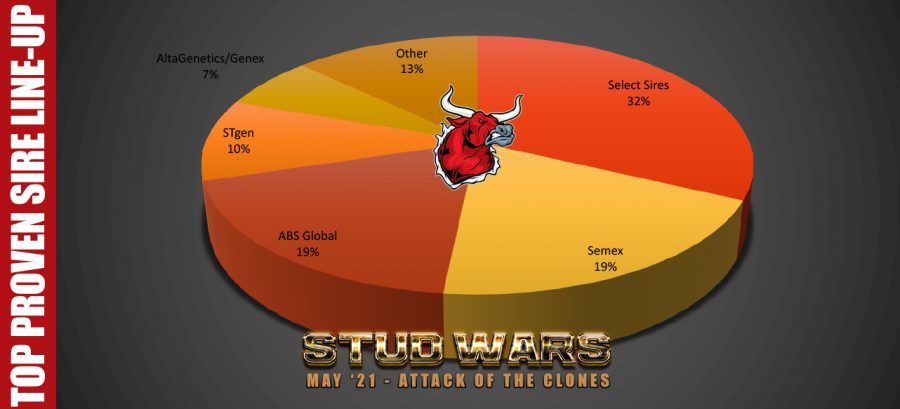

While Select Sires once dominated with 52% of the top proven sire TPI ranks back in Stud Wars Episode IV – The Force Grows Stronger 2016, they still hold control though ABS Global has bounced back in recent years and now occupies the #2 spot, by filling their genomic pipeline three years ago. Also coming on strong is STgen who, like ABS Global, made significant investments in recent years and saw positive returns. Of interesting note is that despite the merger of Genex and Alta Genetics that held a combined 28% back in our initial battle for supremacy, they now only occupy 8% combined.

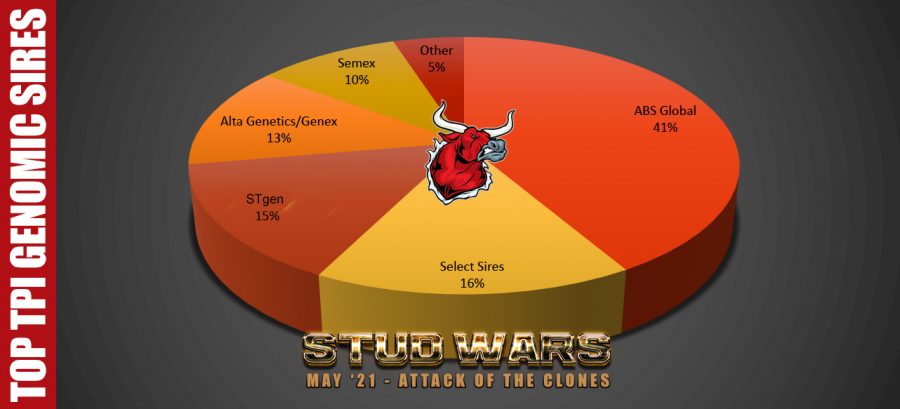

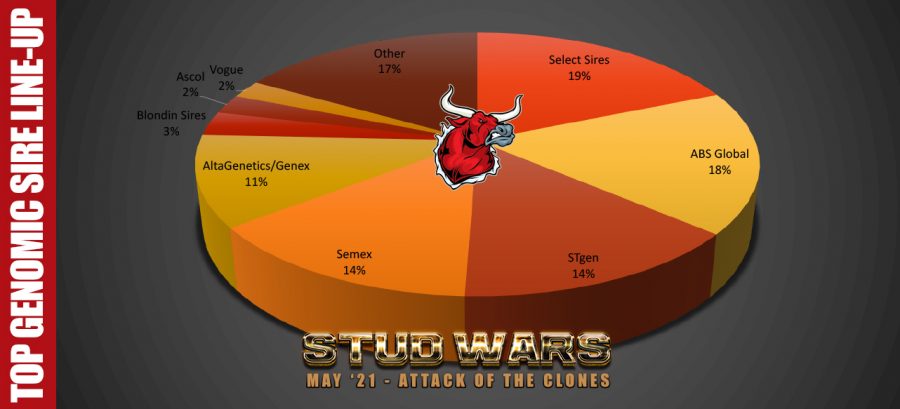

There is no question that ABS global has gone heavily into the top Genomic TPI sires. With 41% of the top sires, they have control over the top end TPI sires in the world. Some key partnerships with De Novo Genetics (De-Su Holsteins), Windstar Genetics and Pine-Tree Holsteins have paid dividends for ABS. Topping this list are Genosource Captain and his two clone brothers Jack and John available from STgen.

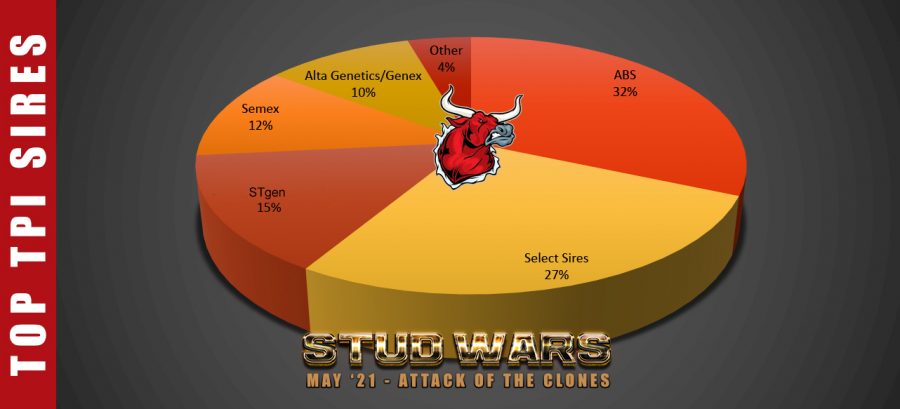

At one time there were many players in the Top TPI sire lists. But with sexed semen and AI companies launching their own female programs, the top TPI sires are now controlled by very few organizations. ABS has taken over the crown from Select Sires. The two companies now control over 59% of the top TPI sires in the world.

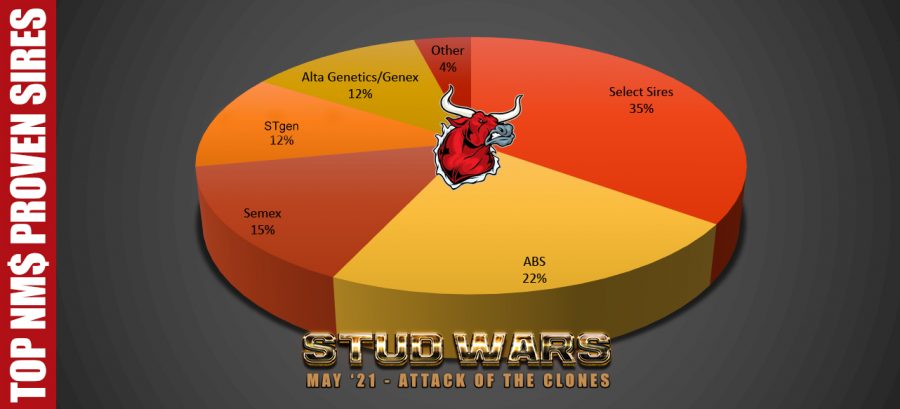

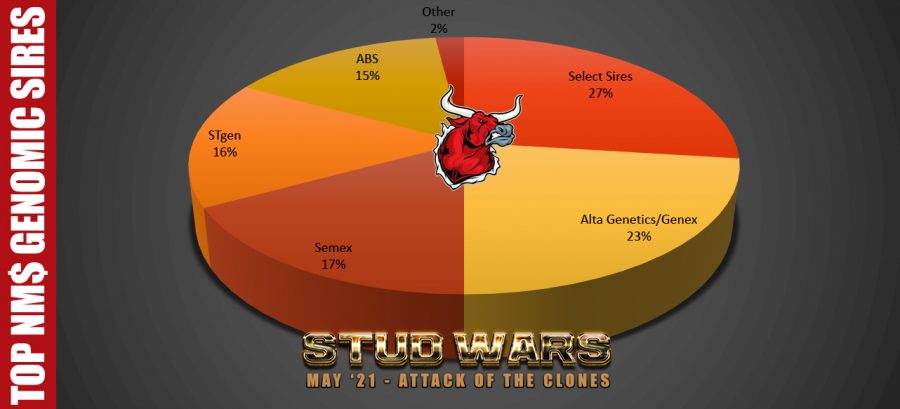

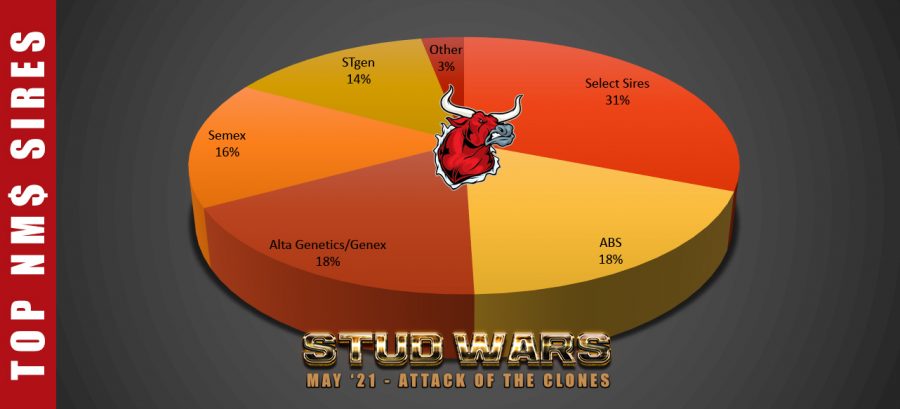

NM$

Continuing their dominance from the top TPI lists, Select Sires and ABS Global also dominate the NM$ proven lists. Of interesting note here is that Semex has come on in this category and now occupies 15% of the top proven NM$ sires. STgen has also seen significant improvement as a result of heavy investment in genomic NM$ sires three years ago (16% of total) which has translated into 12% of proven NM$ sires.

Looking to regain the lost ground on the proven NM$ sires lists, Alta Genetics/Genex’s Peak program has invested heavily to regain ground lost to the other organisations.

While Select Sires maintains their crown as the best source for NM$ sires, ABS Global has regained ground over the past three years and is now tied with Alta Genetics/Genex for the #2 spot. Semex has been the biggest mover in this category over the past three years and now holds the number three spot with 16%. If the ABS investment in top genomic NM$ sires three years ago is an indicator, watch for Alta Genetics/CRI’s Peak program to move them up on proven sires lists shortly.

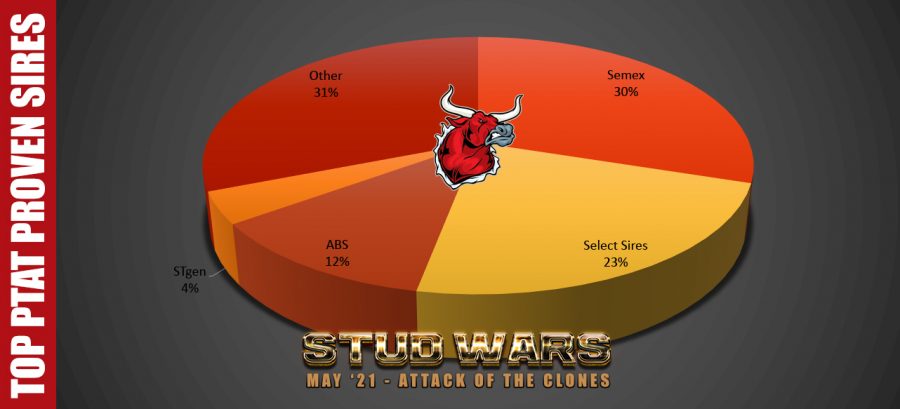

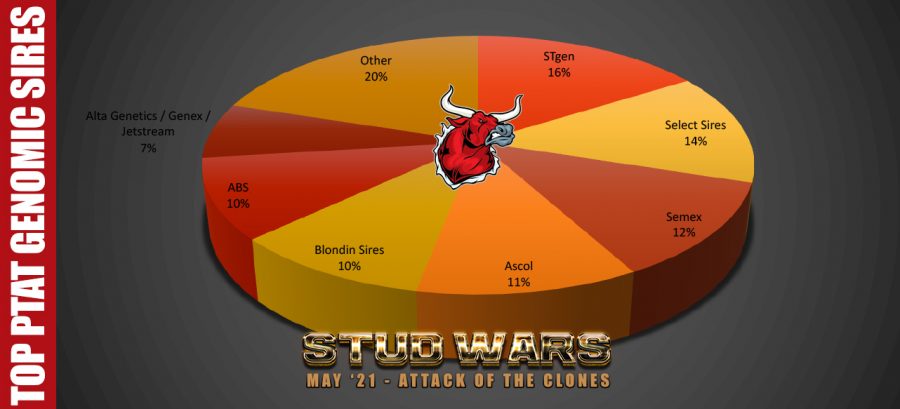

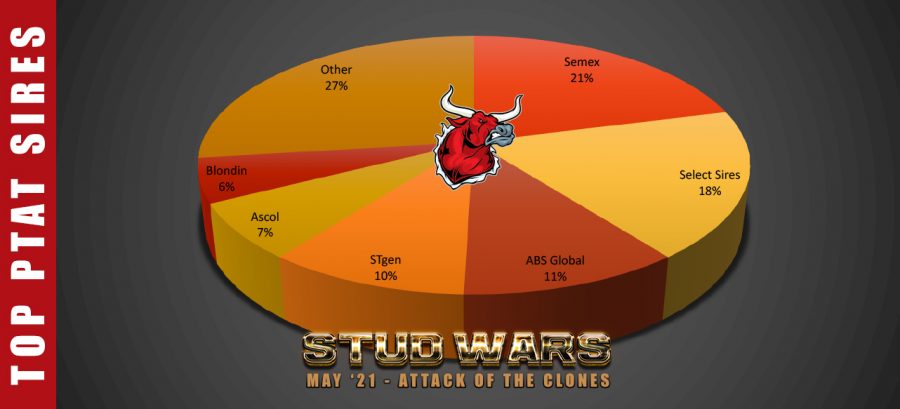

PTAT

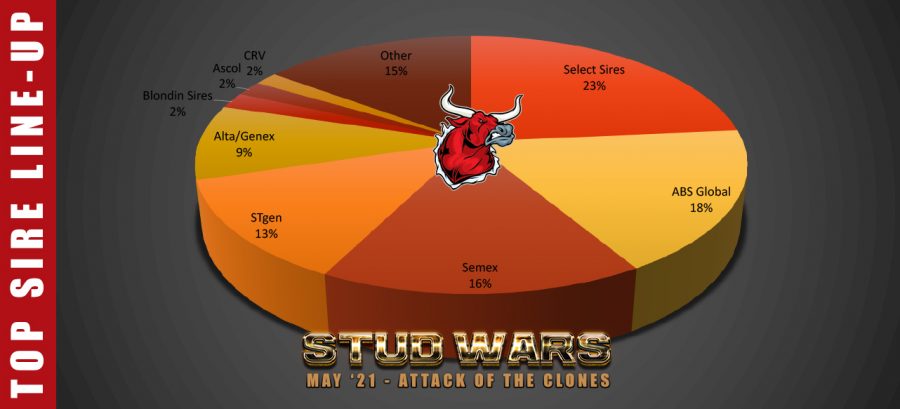

Semex and Select Sires continue to have over half of the top PTAT proven sires in the world. The interesting part about the top PTAT proven sires is that there is still a significant portion, 31% of the sires, that are not controlled by the major AI companies. ABS Global’s significant investment in top Genomic PTAT sires three years ago has seen their share go from under 6% to 12% now.

What was at one time controlled by a select few organizations, the top PTAT Genomic sires are currently spread out among many organizations. Of interesting note among them are the relatively new Blondin Sires in Canada and Ascol from Spain who both have over 10% of the top genomic sires. This is pretty impressive considering the size of their organizations.

What was once a category where Semex and Select Sires controlled over 55% of the sires, there are now several AI companies making their play for this marketplace. Watch for Ascol and Blondin sires to move up, as their recent investments in top genomic sires should pay dividends and result in more top proven sires.

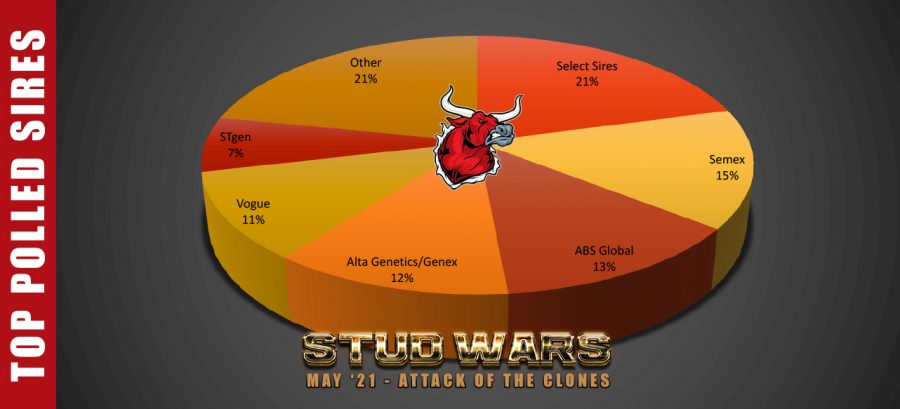

Polled

Polled sires was once a segment that many of the larger organizations did not show much interest in. It now sees all the major AI companies holding a significant share of the top sires. The one standout among these giants is Vogue, which is operated by David Eastman, the man behind GenerVation’s program before selling to Select Sires, and Sean and Kelly O’Connor. (Top 100 TPI Polled sires were included.)

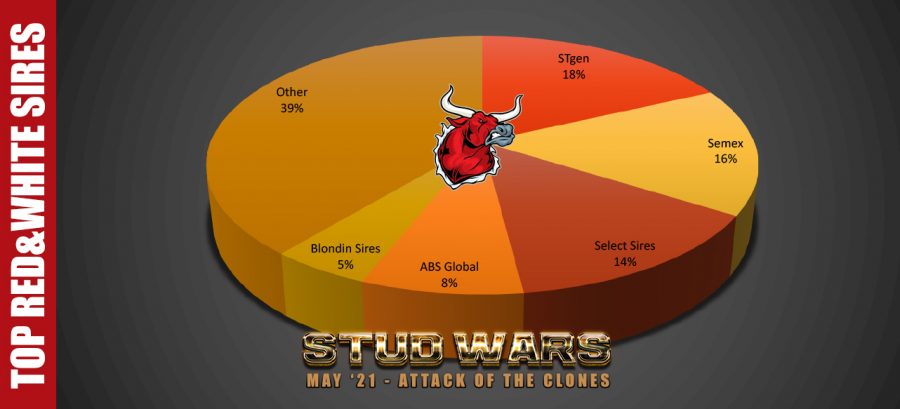

Red and White

Significant investments by STgen have changed the red landscape in recent years. With new players like Blondin Sires, with sires such as Unstoppable, the red landscape continues to change and is certainly one segment of the marketplace that will probably see the greatest change over the next three years. (Top PTAT 100 Red & White Sires used.)

The Bullvine Bottom Line

Select Sires retains its crown as the top source for proven sires. The biggest change over the past three years has seen ABS Global regain its market share and is now tied with Semex for the 2nd strongest proven sire lineup. STgen has also shown significant return on their investment in genomic sires and now cracks the top 4.

By just 6 sires Select Sires maintains the #1 spot for genomic sires. Players like ABS Global and the Peak program from AltaGenetics/Genex are making significant impact on who has control of the top genomic sires worldwide.

Select Sires retains the crown as the best sire line up. Of interesting note are the gains made by ABS Global that has almost doubled their share of the top sires and now is the 2nd best sire line up worldwide. Semex maintains its share and holds the #3 spot, followed by STgen that has increased their market share.

As the performance over the past 6 years of doing this analysis shows, A.I. organization global positioning is not a forever – it is only maintained if an investment is made in the very top genomic sires.