Trump’s bid to crack Canada’s $17B dairy market faces political landmines. Why new tariffs may backfire—and what producers should do now.

EXECUTIVE SUMMARY: Despite Trump’s threats of retaliatory tariffs, Canada’s bulletproof supply management system, entrenched political interests, and pending legislation (Bill C-282) make major dairy concessions unlikely. The USMCA’s limited 3.5% market access has boosted exports by 81% in key categories, but unfilled quotas and restrictive TRQ rules persist. With Canada’s April election amplifying dairy’s political clout and US tariffs risking $285M in self-harm, experts urge producers to focus on quota optimization and diversification rather than relying on political breakthroughs.

KEY TAKEAWAYS

- Structural Barriers: Canada’s $30k/cow production quotas and TRQ administration costs create effective tariffs of 19-27% beyond listed rates.

- Political Ticking Clock: April’s election and Bill C-282 could permanently shield Canada’s dairy policies from US demands.

- USMCA’s Double-Edged Sword: While fluid milk exports surged 81%, 58% of quotas go unfilled due to processing requirements.

- Survival Strategy: Smart producers target underutilized categories (yogurt/ice cream) and diversify to Mexico’s +22% growth market.

- 2026 Countdown: USMCA renegotiation begins July 2026—documenting TRQ barriers now is critical for future leverage.

Here’s the cold truth: The second Trump administration faces the near-impossible task of prying open Canada’s dairy market. Despite threatening 25% retaliatory tariffs set to drop on April 2nd, 2025, our investigation reveals why political realities and bulletproof Canadian policies might leave American dairy producers empty-handed…again.

The $1.1 Billion Paradox: Why Record Exports Still Leave US Dairy Hungry

Let’s cut through the noise with complex numbers that tell the real story:

| Metric | 2024 Value | Growth Since USMCA |

| U.S. Exports to Canada | $1.14 billion | +34% |

| Canadian Exports to US | $250 million | -18% |

| Unfilled US Quotas | 58% average | N/A |

America’s dairy trade surplus with Canada keeps growing, yet producers rage about “stolen” market access. Why? Because Canada’s supply management system remains the ultimate gatekeeper.

“Think of it like winning permission to enter a fortress, but finding the drawbridge only lowers halfway,” explains Christopher Wolf, Cornell agricultural economist and co-author of groundbreaking USMCA research. “Our study shows TRQ administration costs add 19-27% to effective tariffs – that’s the real trade barrier”.

Decoding Canada’s Dairy Fortress: How 9,400 Farms Control a $17B Market

The Three Pillars of Protection

- Production Quotas: Farmers buy rights to produce milk at $30,000/cow – creating $3M entry fees for 100-head herds

- Cost-Plus Pricing: Milk prices cover production + profit margins guaranteed by the government

- TRQ Artillery: 298% butter tariffs, 241% milk tariffs blast imports exceeding quotas

Quebec’s $6B GDP Hammer: With 47% of Canada’s dairy farms, Quebec’s 80,000 supply management jobs make it political kryptonite. “No party dares touch supply management here – it’s third rail politics,” says McGill’s Pascal Theriault.

“Our system isn’t about protection – it’s about survival. Without it, 90% of Quebec dairies would fold within 5 years.”

– Unnamed Dairy Farmers of Canada Executive

The Election Wildcard: Why April 28th Dooms Trump’s Demands

Canada’s federal election timing creates a perfect storm:

- 12 Marginal Rural Ridings where dairy votes decide winners

- Bill C-282 progressing through Senate – would ban future TRQ increases

- Lobbying Blitz: 647 DFC meetings with officials in 2024 alone

“Politicians would rather face Trump’s tariffs than lose Quebec,” says C.D. Howe Institute trade analyst Meredith Lilly. “Supply management isn’t policy – it’s national identity.”

USMCA’s Bittersweet Victory: The 81% Surge That Changed Nothing

While Trump touts USMCA as “fixing” dairy, the data reveals Schrödinger’s trade deal – simultaneously successful and inadequate:

Post-USMCA Wins

- Fluid milk exports: +81% value

- Butter shipments: +81% unit value

- Monthly trade boost: +$12M

Persistent Roadblocks

- 85% of TRQs are reserved for Canadian processors

- “Further processing” requirements on 50-85% of quotas

- Export caps on SMP (35,000MT by 2026)

Texas Tech researchers calculated the grim reality: “Even if filled, USMCA quotas only cover 3.2% of Canada’s dairy consumption. It’s crumbs from their table”.

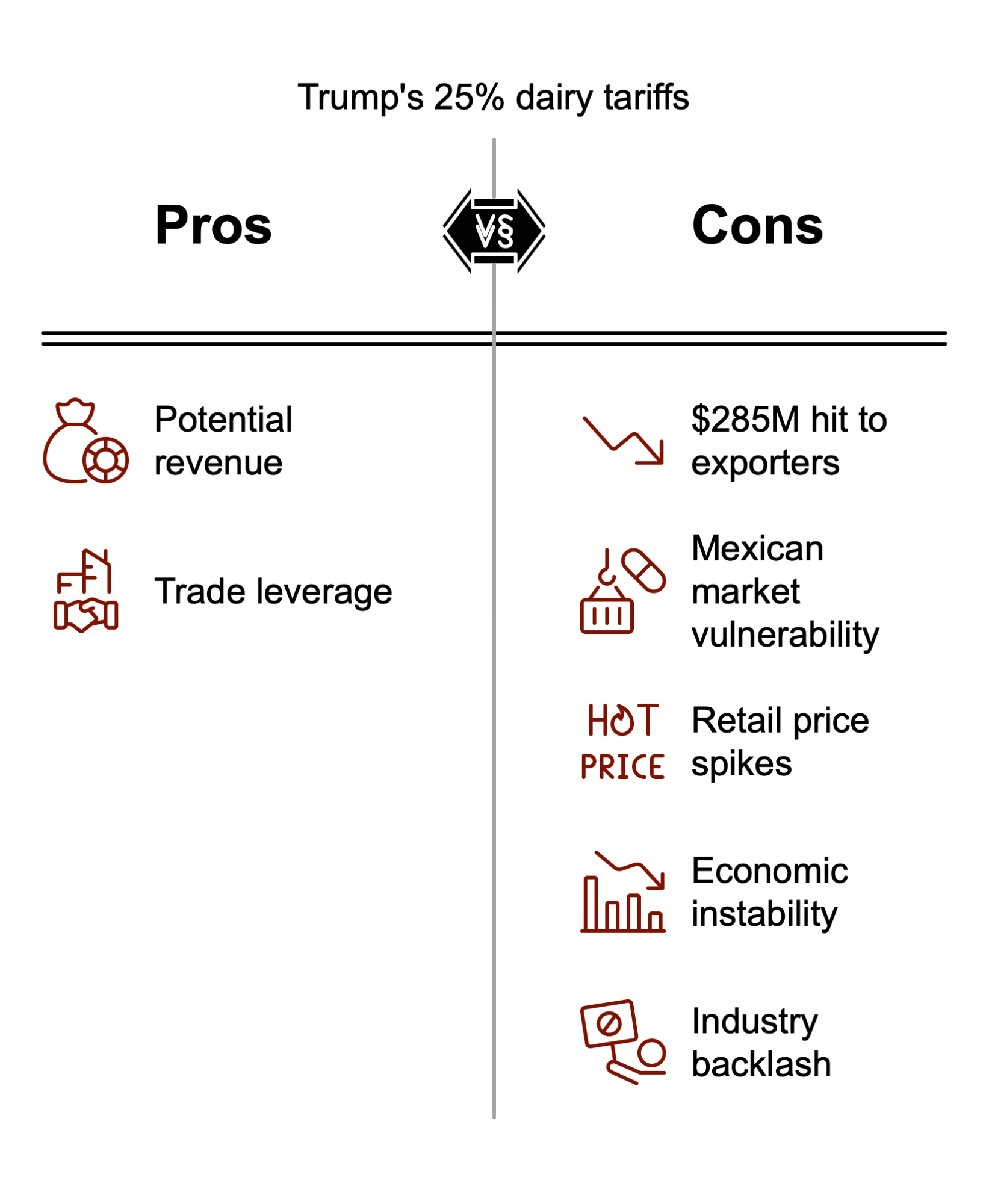

The Trump Card: Will April 2nd Tariffs Backfire?

Trump’s threatened 25% dairy tariffs risk a dangerous game:

Potential Impacts

- $285M immediate hit to US exporters (25% of 2024 exports)

- Mexican market vulnerability (43% of US dairy exports)

- Retail price spikes in border states

“Tariffs are a shotgun approach to a scalpel problem,” warns IDFA CEO Michael Dykes. “We need surgical enforcement, not trade wars”.

3 Strategic Moves for Smart Producers

- Quota Maximization: Target underfilled categories like ice cream (+690MT quota) and yogurt (+4,135MT)

- Product Reformulation: Develop “further processing” compliant items for TRQ eligibility

- Diversification Play: Shift focus to Mexico’s booming dairy imports (+22% since 2020)

The 2026 Countdown: With USMCA review looming, the real battle begins July 1st. Winners will be those using the next 18 months to:

- Build coalitions with Canadian processors

- Document every TRQ obstruction

- Prepare WTO challenges on quota administration

As Texas Tech’s trade team bluntly states: “Complaining about Canada’s 300% tariffs misses the point. The real game is mastering their quota maze –where the $519M opportunity lives”.

Final Thought: In this high-stakes dairy poker game, Trump holds a pair while Canada sits on a royal flush. Savvy players aren’t waiting for political miracles – they’re adapting to win within today’s rules. Will you?

Learn more:

- Global Dairy Trade Auction Hits 30-Month High: Key Takeaways for Farmers

Explore how rising global dairy prices and shifting market dynamics impact farmers, with actionable strategies to leverage these trends. - U.S. Commerce Secretary Nominee Challenges Canadian Dairy Trade

Dive into Howard Lutnick’s push for expanded U.S. dairy access to Canada and the implications for farmers on both sides of the border. - How a Trade War with Mexico Could Devastate the US Dairy Industry

Understand the risks of Mexican retaliatory tariffs and strategies to diversify markets and stabilize farm-gate revenue amidst trade uncertainty.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!